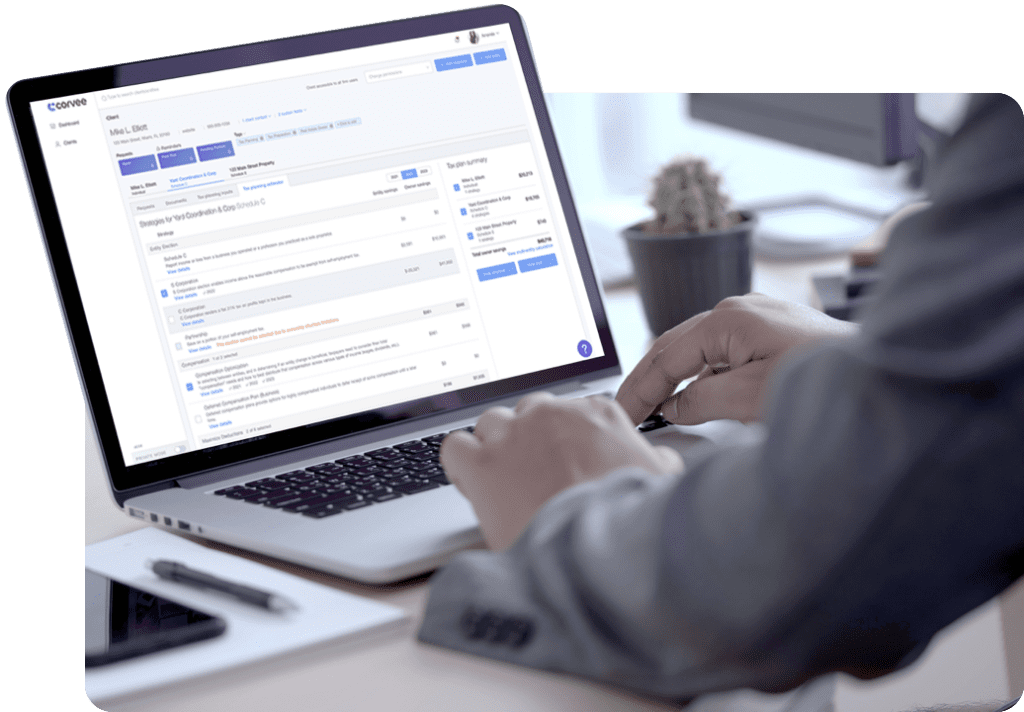

Create tax plans utilizing over a thousand tax strategies in all 50 US states and DC. Whether the state strategy conforms to the federal strategy or not, each state strategy is linked to its corresponding federal strategy and also shows you the estimated tax savings at both the federal and state levels. Each strategy comes with a description, entity considerations and IRS and state code references, alongside a jurisdiction summary with key deadlines.

Create tax plans utilizing over a thousand tax strategies in all 50 US states and DC.

Whether the state strategy conforms to the federal strategy or not, each state

strategy is linked to its corresponding federal strategy and also shows you the

estimated tax savings at both the federal and state levels. Each strategy comes with

a description, entity considerations and IRS and state code references, alongside a

jurisdiction summary with key deadlines.

Create tax plans utilizing over a thousand tax strategies in all 50 US states and DC. Whether the state strategy conforms to the federal strategy or not, each state strategy is linked to its corresponding federal strategy and also shows you the estimated tax savings at both the federal and state levels. Each strategy comes with a description, entity considerations and IRS and state code references, alongside a jurisdiction summary with key deadlines.

Across each state, Corvee allows you to estimate corporate income tax, personal income tax, franchise tax and excise tax so you feel confident knowing the effects of your entity election and tax strategy recommendations.

Across each state, Corvee allows you to estimate corporate income tax, personal

income tax, franchise tax and excise tax so you feel confident knowing the effects of

your entity election and tax strategy recommendations.

Across each state, Corvee allows you to estimate corporate income tax, personal income tax, franchise tax and excise tax so you feel confident knowing the effects of your entity election and tax strategy recommendations.

Tax strategy conformity is the degree to which a tax planning strategy matches at

the federal and state level of the tax code. Some states adopt the same approach

for a strategy, some disallow it, some have adjustments and some have custom

calculations. With Corvee, you can easily see each tax strategy’s conformity type

and how it affects your tax savings calculation:

Tax strategy conformity is the degree to which a tax planning strategy matches at the federal and state level of the tax code. Some states adopt the same approach for a strategy, some disallow it, some have adjustments and some have custom calculations. With Corvee, you can easily see each tax strategy’s conformity type and how it affects your tax savings calculation:

For decades, the tax industry has focused on filing tax forms. Once a form is completed, a tax preparer moves onto the next one. However, almost every business decision affects the 1040, and vice versa. Corvee has created a multi-entity tax calculation that allows you to see how a change on any entity affects all taxes, including state taxes and savings, instantly.

Enhanced tax plans with a summary of state tax savings, jurisdiction, state tax

strategy information, state code references and strategy calculations that show

state tax savings.

Enhanced tax plans with a summary of state tax savings, jurisdiction, state tax strategy information, state code references and strategy calculations that show state tax savings.

For decades, the tax industry has focused on filing tax forms. Once a form is

completed, a tax preparer moves onto the next one. However, almost every

business decision affects the 1040, and vice versa. Corvee has created a multi-

entity tax calculation that allows you to see how a change on any entity affects all

taxes, including state taxes and savings, instantly.

For decades, the tax industry has focused on filing tax forms. Once a form is completed, a tax preparer moves onto the next one. However, almost every business decision affects the 1040, and vice versa. Corvee has created a multi-entity tax calculation that allows you to see how a change on any entity affects all taxes, including state taxes and savings, instantly.

Find the best entity type for your clients. Compare the tax benefits across business structures:

Corvee will also help you plan for reasonable compensation and income optimization with visibility into state tax effects and estimated tax savings.

Find the best entity type for your clients. Compare the tax

benefits across business structures:

Find the best entity type for your clients. Compare the tax benefits across business structures:

Corvee will also help you plan for reasonable compensation and

income optimization with visibility into state tax effects and

estimated tax savings.

Corvee will also help you plan for reasonable compensation and income optimization with visibility into state tax effects and estimated tax savings.

Join 10,000+ customers who are already saving money in taxes.

Add state & local tax planning today.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.