Financial advising starts with tax planning, which reduces the amount your clients owe in taxes. Financial advisors who tax plan don’t have to know everything that an experienced accountant knows. If you’ve never done tax planning before, you can still easily master 5-8 core strategies and use tax planning software for financial advisors to apply dozens more. Tax planning is faster and easier than ever before with Corvee Tax Planning software. Analyze estimated tax savings and prepare proposals in minutes!

Not an accountant or CPA? We have already scoured the tax code so you don’t have to. Our tax planning software gives financial advisors all of the most common and effective tax strategies for:

Corvee Tax Planning software for financial advisors helps you save clients tens to hundreds of thousands of dollars in taxes every single year. With tax rates and policies continuing to increase the amount of taxes many people could owe, there is no shortage of businesses and individuals looking for legal ways to pay less money to the IRS. Financial advisors who specialize in tax planning will be in great demand.

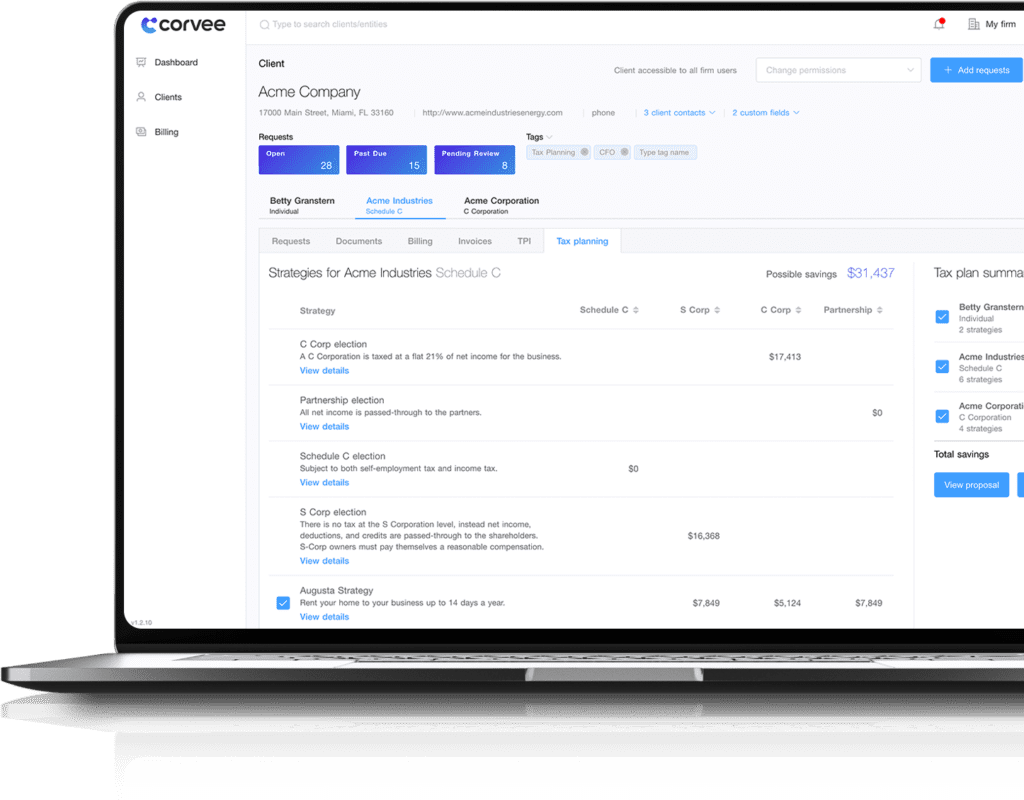

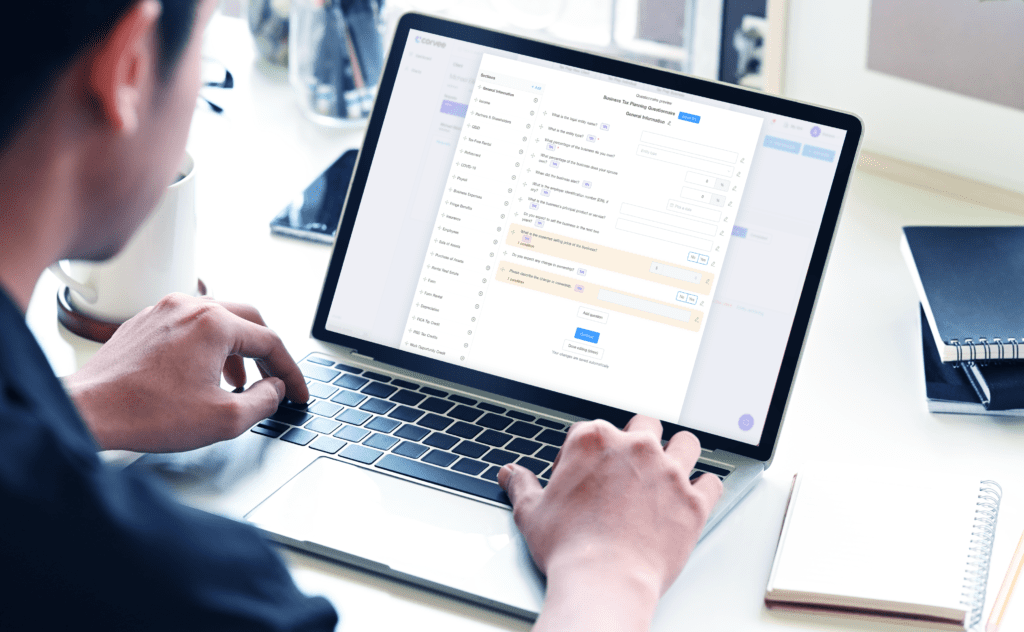

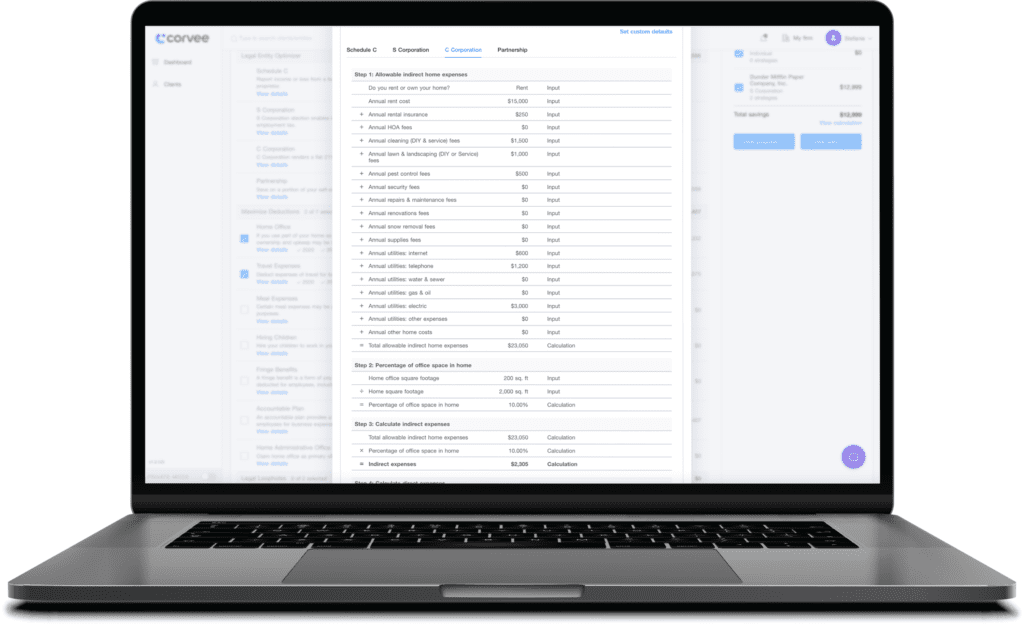

Our financial advisor tax planning software formulates a tax savings calculation in minutes, enabling you to be the complete financial expert your clients seek. We use smart questionnaires for the individual, and each entity. These questionnaires help you get every single data point you need from clients to determine prior year estimated overpayment, current year and future year savings. The vast majority of CPAs don’t offer this, so it is a great way to grow your client base as a financial advisor.

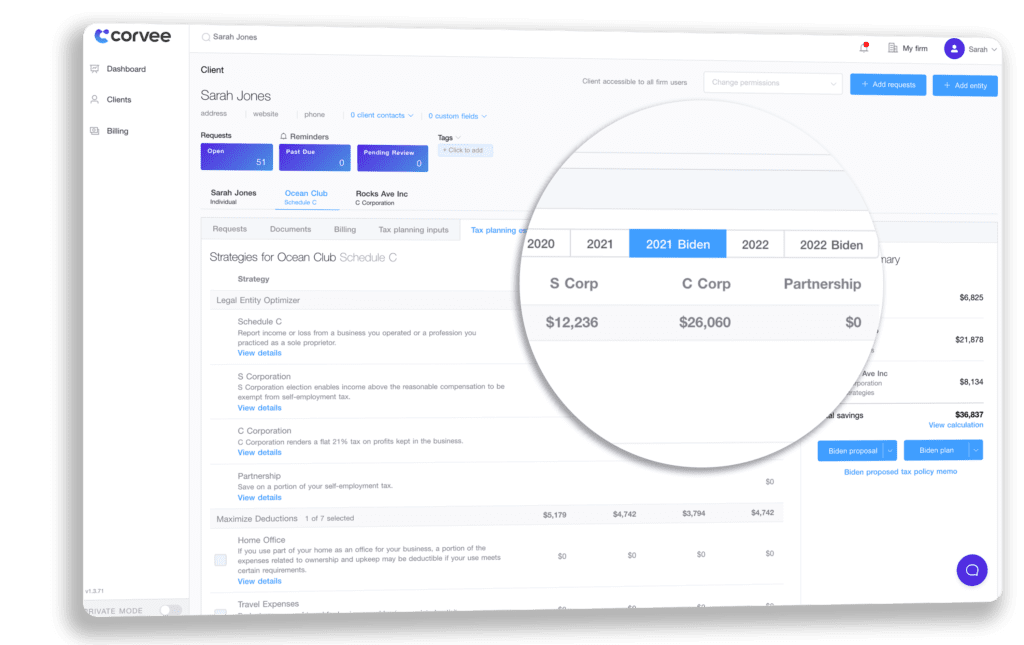

We know that tax laws change frequently, so we allow you to compare strategies using current tax law versus tax proposals. This helps to give you all the information you need in order to build the best, most comprehensive tax plans possible.

Our tax software allows you to see exactly how each tax planning strategy is calculated, plus it gives you the ability to adjust your final inputs. If all that weren’t enough, financial advisors can select which strategies they want to recommend in their final tax plan. You’ll be able to easily calculate deductions, credits, phase outs, tax rates, and savings per strategy and entity!

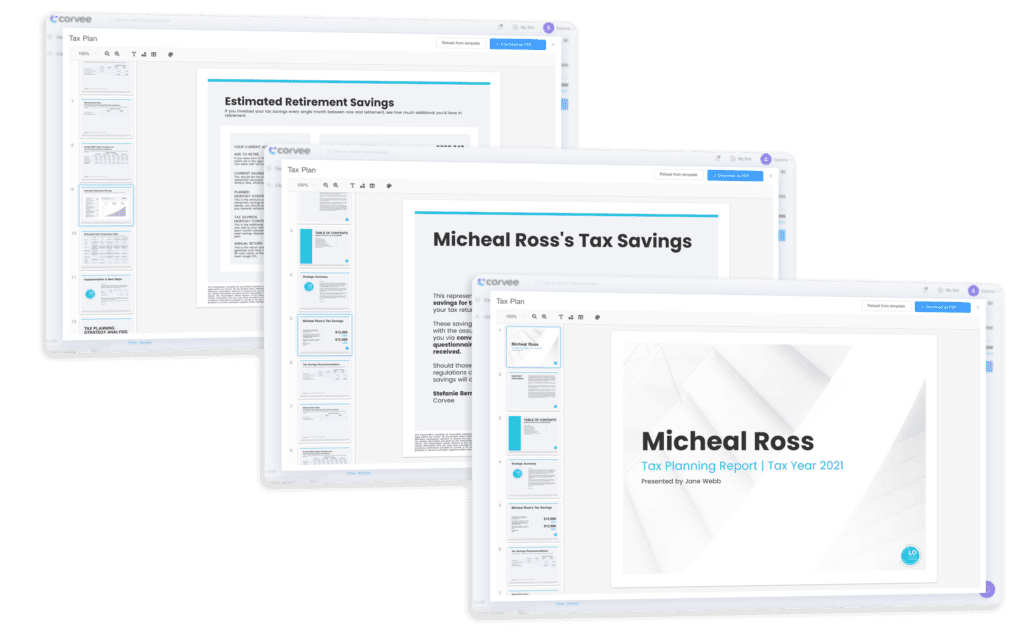

Gain clients as a financial advisor by offering a service many other firms neglect: tax planning. Corvee Tax Planning software for financial advisors compiles your customized tax planning strategy and recommendations into a ready-to-send PDF file that contains the following:

These custom tax plans will benefit both your clients and your firm. Find your niche market with Corvee Tax Planning software for financial advisors.

If you haven’t been helping your financial advising clients save money on taxes, or you have been but are not getting paid for it, our tax planning software is for you. It not only helps you create tax plans, but also helps educate you on tax planning strategies as well as how to apply them to your clients. You can also estimate how much you can save a client in taxes and recommend investment and insurance products as tax planning strategies. Tax planning has proven to be a key client acquisition strategy for many financial advising firms.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.