14 minute read

Picking a specific niche that your accounting firm specializes in has never been more important. It will help you grow an accounting firm like nothing else can. While there are tons of firms that provide general accounting services, the tax and accounting firms growing at the fastest rate are the ones that build and brand themselves to serve a speciality accounting niche.

Picking a niche to specialize in when owning your own accounting firm is absolutely critical. Often, accounting is seen as simply a “general” profession. Many firms just assume every business needs tax and accounting services, so they market to everyone. The problem is that each business has completely different ways of doing things—the terminology, ideas, and clientele are all niche. This is why it’s more lucrative to specialize and speak “their” language. You’ll be more valuable to them compared to a general accounting practice.

Competitive Advantage—You’ll be able to relate to specific businesses easier and speak their language. This will make you more attractive even with charging higher fees than the generalist firms.

Higher ROI Marketing—With a specific message, you’ll be able to micro-target your audience with precision. Many clients will actually find you because they are searching for an industry specific accountant, someone that “gets them” and their problems.

Better Service—As you begin to specialize in a certain niche, you will understand how to innovate and serve your clients’ specific needs. Your accounting firm eventually becomes the expert in this niche with advanced solutions tailored to these businesses, which results in more satisfied clients creating a positive feedback loop of higher fees and higher retention rates.

There are two main ways you can innovate with a niche in the world of accounting to grow an accounting firm:

#1 Industry Niche

#2 Transformation Niche

Let’s define each.

An industry niche is specific to an industry such as “We’re an accounting firm that specializes in helping restaurants.” It’s a specific type of business you work well with. Maybe it’s dentists, restaurants, e-commerce businesses…the list is endless.

A transformation niche is a specific area inside the world of accounting that you are a rock-star in. “We help businesses with tax planning.” This is a specific area you can help most in. It could be financial coaching, wealth management, exit planning, forecasting…whatever your biggest strength is.

If you really want to narrow it down, you can pick both an industry and a transformation niche to focus on. Keep in mind this doesn’t mean that you can’t take on clients outside this industry or provide services outside your transformation speciality—we are just talking about your main marketing focus right now.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

If you will focus on a specific industry, the difficult part for any accounting firm is to actually choose which niche to focus on. You can’t train to be an expert advisor for every single business type because there’s simply too much to learn. A restaurant has different issues than a construction company, and there’s not enough time in your day to go deep into the specific nuances of both, let alone the other hundreds of industry niches out there.

The key question to ask yourself as you consider if you want to begin creating an industry accounting niche is, “Who do I already work most with and what’s my experience?”

Are 75% of your clients technology companies? Do you have an abundant list of doctors you’re servicing? Look for what general fields your current clients are in and make a list. What percentages fall into where? You may find you already serve a niche, now you just need to go deeper with it and consciously market to this area. Also, what’s your past experience? Before your accounting career, were you a bartender? If you have past experience within an industry, you’ll naturally be able to relate better to these people. Make a list of industries that you feel comfortable with and areas that you have some prior expertise. Maybe your spouse or staff has insight into a particular industry—use that too!

While we recommend your firm has a wide array of services to sell and upsell clients, if you’re a general firm, you could benefit from choosing a specific transformation niche to concentrate on. Perhaps you already feel you’re best at tax planning, or you love doing financial coaching, but hate tax preparation. Maybe you already do a bunch of CFO services, or you expertise in exit planning.

The key question to ask yourself is, “What am I good at or what do I want to be good at?”

Get great at a specific service and you can sell it to a wide variety of industries. But when you combine both an industry specific niche with a transformation niche, you can hyper target!

But the most important thing to consider when choosing either type of niche is…”Is this profitable?”

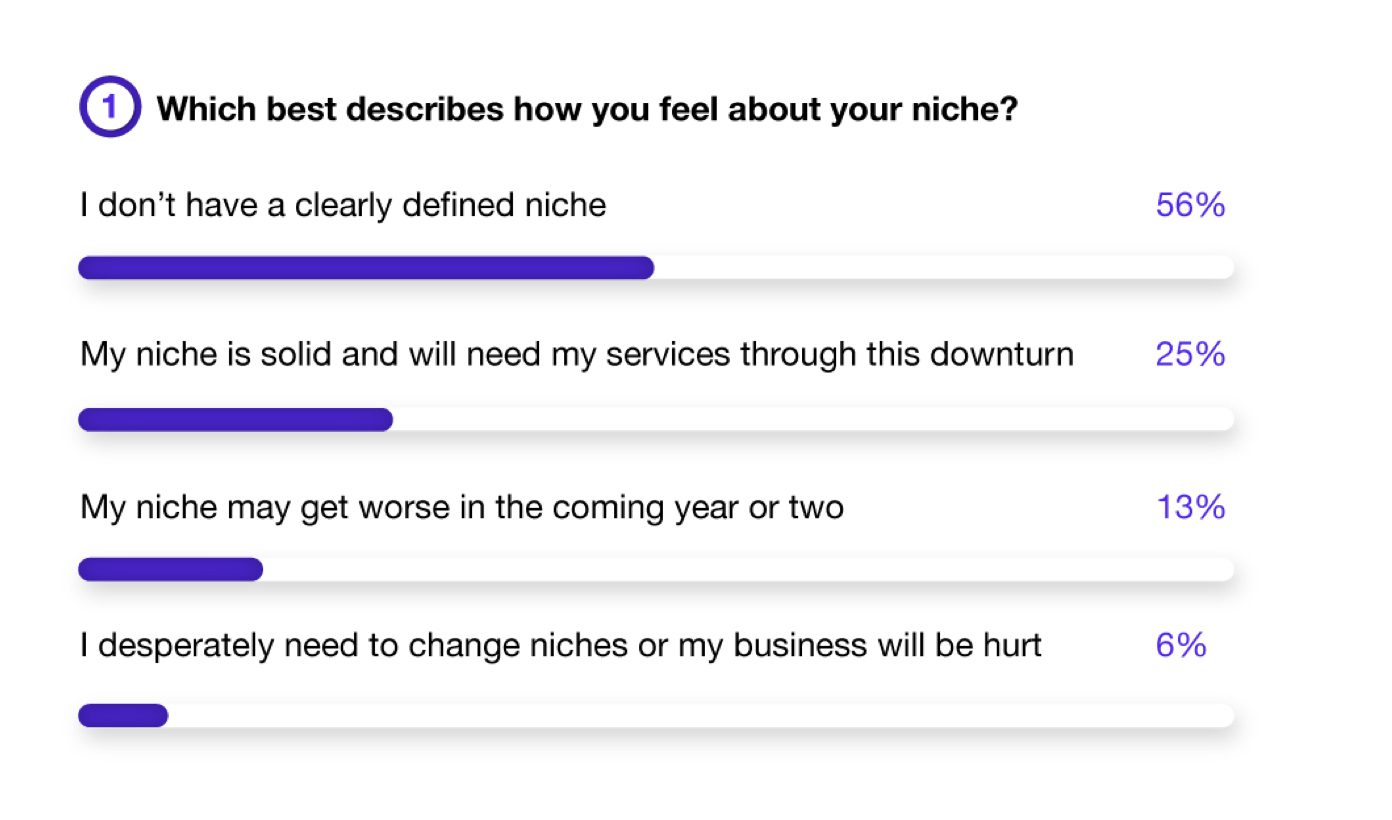

2020 was a tough year economically because of the pandemic. With many businesses cutting costs, accountants are feeling the pressure with client cancellations. We did a survey of more than 100 accountants on how they felt about their niche in 2020. This was the result:

This shows that 75% of the accounting firms we surveyed either have no niche, or the niche they do have is in trouble.

The problem many are facing is that it’s not clear even by industry what niches are profitable. For example, it’s easy to say that the travel industry is in trouble and that accountants should now avoid that niche, but always remember that there are niches within niches.

Full Service Restaurant

Impacted/Unneeded

Butcher Box

Covid Beneficiary

As a general rule in 2020, businesses that focus on the physical world and contact (events, in-person services, retail) have been severely impacted while businesses that focus on digital (e-commerce, delivery) are experiencing skyrocketing growth. So, if you’re looking to pick a new accounting niche in 2021, be sure to pick an industry that is doing well, or pick a thriving business inside an industry that is overall suffering.

Based on the current economy and the changes in consumer and economic behavior, the need for their services has been partially or largely diminished (i.e. escape room, vacation rentals, gyms, craft brewery)

These companies were impacted by the crisis, however, because these company’s offerings are needed, they will recover maybe not 100%, but they will likely have a viable business going forward (doctors, dentists, chiropractors, etc)

These businesses largely continued to operate under the trend they had before the crisis. They were either not ordered to shut down and maintained business, or had a digital business (construction, online consultant, etc)

These businesses not only survived, they thrived through the crisis and saw increases in demand, revenue, customers, and oftentimes profitability. This happened to some as a result of the business they already had (delivery, cybersecurity, e-commerce, etc) or they pivoted to serve growing niches (mask making, hand sanitizer, etc)

Focus on companies that are more digitally oriented.

Understand which category your clients falls into:

Perform a discovery call to understand their situation

Decide what services to offer depending on their situation

The good news in all this is that we found certain accounting firms have thrived by focusing on certain transformation niches. The key is to parse through the haves and the have nots to find the profitable companies in this economy. Why is this? Because the most important divide in the next few years will be Advisory vs. Compliance. Advisory services help your clients make money, compliance services are basically just costs.

This is why advisory services are a HOT transformational accounting niche in 2021. For example, we found that when the pandemic shut down the economy, distressed businesses who were impacted or unneeded were looking for legislative and lending consulting services for the PPP, EIDL, CARES act, and forecasting/budgeting to manage cash flow. Meanwhile, growing niches that have been unaffected or benefitted from the pandemic are needing higher-level advisory services like tax planning and CFO.

Keep in mind, there is still opportunity in 2021 for accounting firms to serve distressed offerings.

Remember, accounting generalists that work with anyone have a harder time commanding higher fees because it’s more difficult to sell when what you’re selling is basically a commodity. Accounting firms that sell to niches can specialize and therefore charge for that expertise.

Generalist Accountant (Me Focused)—We are the largest accounting firm in northwest Oregon. We’ve served clients since 1991. We have 3 offices and we’d love to discuss how we can serve you!

Niche Accountant (Client Focused)—ChiroPro isn’t just a group of accountants, we’re financial experts for chiropractors. We can help you with all your tax and accounting functions to make the most profit possible. While most accounting firms just help with your tax prep, that’s just where we start. We help you focus on chiropractic forecasting and budget management, chiropractic wealth management, chiropractic practice acquisitions, consulting, tax planning, payroll, and insurance. In short, we craft everything we do specifically for chiropractors.

Do you see the difference?

If you want to know how to grow an accounting firm, then pick a niche and begin to market and innovate for that specific industry or person. Learn about the services they need and how you can give them the most value. Learn how to set up their specific P&L, how to incentivize their staff, and how to make their processes better. Discover new services specifically for them…and you will create value that never existed before.

When you know your accounting niche like this, general accountants won’t be able to even compete with you!

If you’re ready to explore deeper which industry niches you can potentially target, and how to become a member of 7 Figure Firms, click on the button below. You’ll also be given the opportunity to demo our accounting practice software for tax planning so you can start implementing tax planning services!

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.