7 minute read

Understanding the Modified Accelerated Cost Recovery System (MACRS) is crucial for businesses managing asset depreciation. This comprehensive guide explores the MACRS depreciation method, including its calculation formulas, depreciation tables, and practical examples. Whether you’re dealing with 5-year, 7-year, or other MACRS tables, we’ll break down the differences between the General Depreciation System (GDS) and Alternative Depreciation System (ADS). Learn how to navigate MACRS depreciation for various asset classes, from vehicles to buildings, and discover when to use straight-line versus declining balance methods. By mastering MACRS, you’ll be better equipped to optimize your tax strategy and accurately report asset depreciation.

Asset depreciation looks different for every business because depreciation is based on many different factors, including:

Most importantly, depreciation is heavily dependent on the depreciation method that you use.

For financial statement purposes, businesses can choose from four different depreciation methods, but for tax purposes, there is only one predominant option: Modified Accelerated Cost Recovery System (MACRS). This method is used to calculate depreciation for business and individual taxes. MACRS has been the primary tax depreciation method since it replaced the Accelerated Cost Recovery System (ACRS) in 1986.

When taxpayers purchase capital assets, they aren’t allowed to deduct the full cost on their tax returns right away (unless they accelerate depreciation with a special allowance like bonus depreciation or Section 179). Instead, they are required to deduct a little bit of that cost each year over the asset’s stated recovery period or useful life. MACRS refers to the calculation methodology that determines this annual deduction.

There are two distinct calculation methods that fall under the MACRS umbrella: the general depreciation system (GDS) and the alternative depreciation system (ADS). Let’s discuss both.

When taxpayers purchase capital assets, they cannot immediately deduct the full cost on their tax return unless they accelerate depreciation with a special allowance like bonus depreciation or Section 179 of the IRS Code. Instead, they have to deduct a little bit of that cost each year over the asset’s stated recovery period or useful life.

MARCS refers to the calculation methodology that determines this annual deduction. Two distinct calculation methods that fall under the MACRS umbrella: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS).

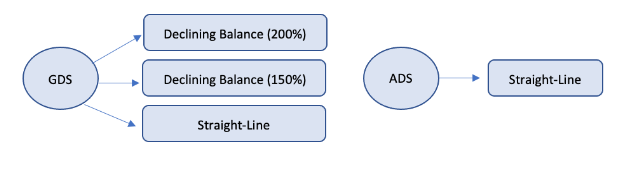

GDS is the default MACRS method for most taxpayers: GDS helps you recover your costs faster than ADS because it weighs your depreciation deductions more heavily in the first several years and utilizes three depreciation methods.

GDS MACRS Depreciation uses a mixture of declining balance (used most often) and straight-line recovery methods. In the declining balance method the depreciation rate is the greatest in the first few years of the asset’s useful life then decreases as the asset ages. For example, if an asset that costs $1,500 is depreciated at 20% per year, the deduction is $1,200 in the first year and $960 the second year, etc.

ADS MACRS Depreciation applies a straight-line method to all assets, meaning that for an asset’s useful life the same amount of money will be deducted each year. If $100 is deducted the second year, $100 will be deducted the fourth year. Depending on when you placed the asset in service, the first and last years will be different.

Learning how to calculate MACRS depreciation by hand is unnecessary because most businesses use software that calculates and tracks depreciation. But understanding how it works can be helpful when determining whether you want to choose to accelerate your depreciation (with bonus depreciation or Section 179) or continue using MACRS.

Before calculating depreciation, it is important to know:

Here are a few examples on how to calculate MACRS depreciation:

MACRS Depreciation Example: GDS Straight Line

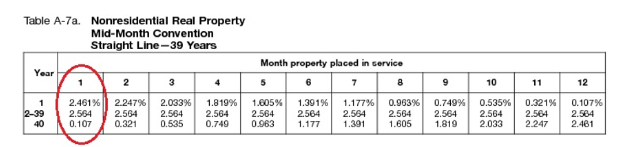

You purchase a non-residential building for $1.4M with a $200K salvage value on January 1, 2022 and place it into service on January 25, 2022. With help from the IRS, you determine that your building has a 39-year class life and that you should use IRS Table A-7a to calculate depreciation.

This is how to use the table to calculate each year’s depreciation deduction:

($1,400,000 – $200,000) X 2.461% = $29,532 Year 1 Depreciation

($1,400,000 – $200,000) X 2.564% = $30,768 Years 2 through 39 Depreciation

($1,400,000 – $200,000) X .107% = $1,284 Year 40 Depreciation

MACRS Depreciation Example: GDS Declining Balance

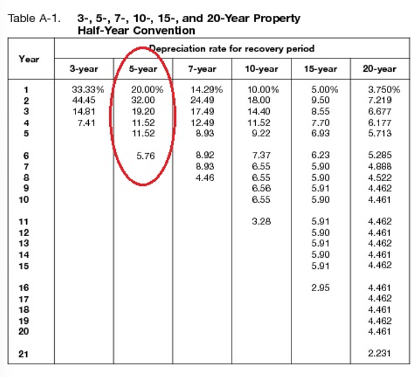

You purchase a vehicle for $15K on February 15, 2022 and place it into service immediately. The equipment should have a $1K salvage value at the end of its useful life. With help from the IRS, you determine that your vehicle has a 5-year class life and that you should use IRS Table A-1 to calculate depreciation.

This is how to use the table to calculate each year’s depreciation deduction.

($15,000 – $1,000) X 20.00% = $2,800 Year 1 Depreciation

($15,000 – $1,000) X 32.00% = $4,480 Year 2 Depreciation

($15,000 – $1,000) X 19.20% = $2,688 Year 3 Depreciation

($15,000 – $1,000) X 11.52% = $1,613 Year 4 Depreciation

($15,000 – $1,000) X 11.52% = $1,613 Year 5 Depreciation($15,000 – $1,000) X 5.76% = $806 Year 6 Depreciation

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

Here are few commonly asked questions about MACRS depreciation:

What is the MACRS depreciation formula?

There are formulas that can help you calculate depreciation by hand, but these formulas can get complicated. We recommend that you only use the tables provided by the IRS when calculating MACRS depreciation for accuracy and compliance.

Can mortgaged property be depreciated using MACRS?

Yes, it can. Even if your property has a lien on it, you can take depreciation deductions under MACRS.

Can a nonprofit use MACRS Depreciation?

Most nonprofits will not be required to use MACRS depreciation. Nonprofits file informational returns with the IRS, not income tax returns. Because their earnings are not taxable, they do not need to recalculate their depreciation to reflect MACRS. On their Statement of Functional Expenses on Form 990, they can report depreciation using the same method that they use for financial statement purposes.

When do I use mid-quarter vs. half-year convention under MACRS?

If at least 40% of the cost basis of assets were placed into service in the last quarter of the year, you must use the mid-quarter convention depreciation tables.

What’s the difference between 200% declining balance and 150% declining balance?

A 200% declining balance is sometimes referred to as double declining balance because depreciation is roughly doubled compared to standard straight-line depreciation in the first few years. A 150% declining balance increases standard straight-line depreciation by roughly 150%. Most assets will be depreciated using the 200% declining balance method, but the following assets must use the 150% declining balance method.

Income tax depreciation affects nearly every for-profit business. It does not matter how your business was formed, how successful it is, how many owners you have, or how much money you make. If you have capital assets, you’ll have MACRS depreciation. Taking the time to learn how it works will help you understand how your asset purchases will affect your tax returns.

If you are considering a large asset purchase, Corvee tax planning software can help you see how that purchase will impact your taxes in the current year and in the subsequent years.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.