10 minute read

Companies that export US goods often utilize a tax incentive known as an interest charge domestic international sales corporation (IC-DISC). This incentive, which is provided by the tax code and recognized as a legitimate tax-saving maneuver by the IRS, helps US exporters compete globally by reducing their US tax liabilities.

Throughout most of modern American history, the US’s 35%+ corporate tax rate has made it difficult for US exporters to compete globally. But when the Tax Cuts and Jobs Act (TCJA) slashed the corporate tax rate down to 21% in 2018, it put the US in line with most other developed nations, making US exports more competitive in global markets.

This low tax rate and other changes in the TCJA are beneficial to US export businesses, but it simultaneously makes the IC-DISC incentive less effective, especially for C corporations. However, IC-DISCs may soon be making a comeback. The Biden Administration has plans to raise the corporate tax rate, and if a rate hike gets implemented, IC-DISCs will become nearly as appealing as they were prior to the TCJA.

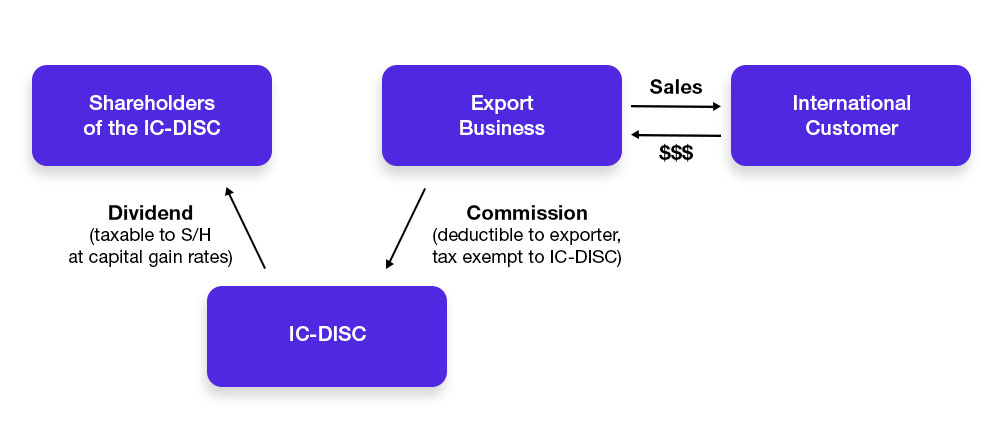

IC-DISCs are tax-exempt corporate entities that act as sales commission agents for export businesses. IC-DISCs don’t have to have employees, office space, provide any services or participate in sales; they are created solely to give exporters a mechanism to legally reduce federal tax liabilities.

For the IC-DISC structure to work, the IC-DISC must be owned by the exporter or its shareholders. If the exporter is a C corporation, the shareholders must form the IC-DISC separately, creating a brother-sister relationship between the two entities based on common ownership. If the exporter is a flow-through entity, the entity can form the IC-DISC as a subsidiary. While it’s not a requirement that IC-DISC shareholders be the same as the export business’s owners, this is often the case.

When the exporter makes a sale to an international customer, they pay a commission to the IC-DISC, which they can deduct as a business expense. This reduces the export business’s taxable income. Because the IC-DISC is a tax-exempt entity, the commissions it receives are free from federal income tax. Those commissions become taxable only when the IC-DISC pays dividends to its owners. Those dividends are taxable to the IC-DISC’s shareholders who will pay, at most, 23.8% on those earnings (20% capital gains tax rate + 3.8% net investment income tax rate).

Prior to the TCJA, when the corporate tax rate was 35%, the tax assessed on dividends was far less than the tax assessed on corporate earnings, making the IC-DISC incentive desirable. By transforming corporate earnings (taxed at 35%) into dividends (taxed at 23.8%), the export business’s owners could reap significant tax savings. Today, much of the IC-DISC benefits have been wiped out for C corporations since the corporate tax rate has dropped to 21%, but IC-DISCs continue to be beneficial to flow-through entities.

Flow-through entity export businesses pass their earnings through to their shareholders or partners, who are taxed on those earnings at individual income tax rates. In 2021, the highest marginal individual income tax rate is 37% but can be reduced to as low as 29.6% if the individual is eligible for the qualified business income (QBI) deduction. This means that if flow-through entities use the IC-DISC incentive today, their owners may be able to reduce their tax rates by up to 5.8 points (29.6% less 23.8%).

To some, this 5.8% tax rate reduction is not worth the effort to create and operate an IC-DISC. Like with C corporations, the IC-DISC incentive was more beneficial to flow-through entities under pre-TCJA law. Pre-TCJA, the highest individual tax rate was 39.6% and there was no QBI deduction, so flow-through exporters could potentially reduce taxes by 15.8 points (39.6% less 23.8%).

Fortunately, the stunted IC-DISC benefit is only temporary.

In 2026, the QBI deduction provision will sunset and tax rates will revert to pre-TCJA law. Barring additional tax law changes, IC-DISCs will become nearly as beneficial to flow-through entities in 2026 than they were prior to the TCJA.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

To operate and utilize the IC-DISC tax structure, the following must be true:

An IC-DISC is a US C corporation that has made a valid IC-DISC election with the IRS. Because it is its own entity, it must maintain a separate set of books, have separate bank accounts, file its own tax returns and pay separate organizational fees.

Additionally, the entity’s outstanding stock must have a par or stated value of at least $2,500 each day of the tax year.

At least 95% of its gross receipts should be commissions from qualifying exports. Qualifying exports are exports of property that are at least 50% manufactured or produced in the US.

At the end of the tax year, at least 95% of its assets must be qualifying export assets. Export assets tend to be commission revenues or receivables.

The IC-DISC election should be made within 90 days prior to the beginning of the first taxable year of the IC-DISC. The election is perpetual until it is revoked by the entity.

Export commissions are paid to IC-DISCs using one of the following calculations, whichever produces the largest commission:

IC-DISCs are typically used to reduce federal tax liabilities, but they provide other benefits beyond tax reduction.

IC-DISCs are not required to immediately distribute their commissions as dividends; they can retain commissions on up to $10M of export sales each year by making annual interest payments to the IRS for the benefit of tax deferral. Although this tax will come due eventually, the tax deferral can give related parties access to working capital that can help them further the goals of their business.

If IC-DISCs retain some of their commissions, they can use those funds to extend a loan back to the export business. This reduces the exporter’s reliance on external financing and boosts available capital.

Although IC-DISCs are not required to perform services in exchange for the commissions they receive, they can. IC-DISCs may be able to help the export business by marketing their activities or promoting their products. The export business must pay for these services, but the service income the IC-DISC receives from the exporter can then be distributed at a preferential rate, just like commissions.

Because IC-DISCs reduce effective tax rates of their owners and IC-DISCs can temporarily defer dividend payouts, they can be powerful estate planning tools.

Depending on how you use your IC-DISC, operating one can be simple or quite complicated, so it’s important you understand what you’re getting into. Our Corvee Tax Planning software has an IC-DISC calculation that can help you determine if it’s a good path forward. Reach out to us today to request a demo.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.