7 minute read

Which states are the best to win the lottery in? What are the worst states to win the lottery? While anyone winning the lottery is lucky, winners in some states are extra lucky, and others aren’t so fortunate. Why? Taxes, of course!

The question with lottery winnings isn’t just how much you win, but how much you actually get to keep. For starters, let’s discuss the difference between federal and state lotteries. There is no official “national” lottery in the United States, but several states have organized two games that are widely available across the country: Powerball and Mega Millions.

These two games can be played in so many areas that they are essentially America’s unofficial “national” lotteries.

While many states have their own state lotteries, and often offer subtractions or exclusions to home state winners, below we’ll talk about winning Powerball and Mega Millions.

It should be noted that no matter what state you’re from, the federal government will impose taxes if you win either of these two jackpots. The backup withholding rate is 24%. Depending on your filing status, expect to pay 37% income tax on the portion of any winnings that exceed $539,900 for single filers and $647,850 for married filing jointly.

After federal taxes are paid, how much of your jackpot you get to keep varies wildly depending on state taxes and how each state treats lottery winnings. In short, what state you’re in matters — a lot.

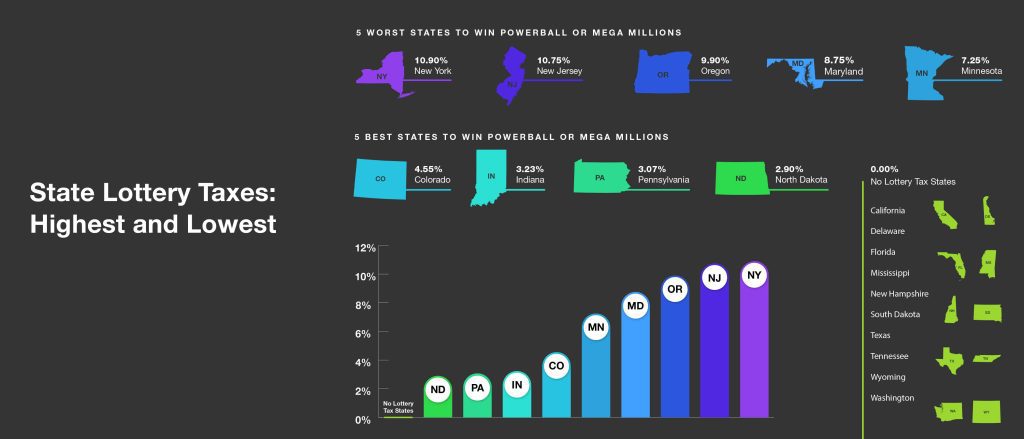

With an income tax rate of 7.25% on lottery prizes, the Land of 10,000 Lakes will take quite a big chunk from your winnings. Worse – if you are a resident of North Dakota or Michigan, you will have to pay taxes to your home state and Minnesota!

With an income tax rate of 8.75% on lottery prizes, Maryland is one of the unlucky places you can win the lottery in. It’s a little better if you are not a resident of Maryland, with “only” 7% being withheld. However, Maryland is one of the few states that will also tax you on your lottery winnings even if you aren’t a state resident!

Oregon’s income tax rates top out at 9.90% on lottery prizes. At that tax bracket, you’re almost paying a full tithe to the state.

With a top income tax rate of 10.75% on lottery prizes, this rather small state is big on securing its share of your winnings. The 10.75% rate only applies when your income exceeds $5,000,000, but if you’re winning the Powerball, that rate will probably apply!

With a potential top income tax rate of 10.90% on lottery prizes, New York takes the cake as the worst place in the United States to win the lottery. The 10.90% rate only kicks in when you have over $25,000,000 in income, making it less likely than in New Jersey for even lottery winners to reach the top bracket, but the lower bracket is still 10.30% – a hefty tax!

There are other states with high taxes on lottery winnings that deserve an honorable mention. Special recognition goes out to Vermont, Iowa and Arizona for having much higher income taxes than the average.

In addition, Alabama, Alaska, Idaho, Nevada, Hawaii and Utah could be considered worse states than New York because they don’t participate in Powerball, so you can’t even purchase a lottery ticket!

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

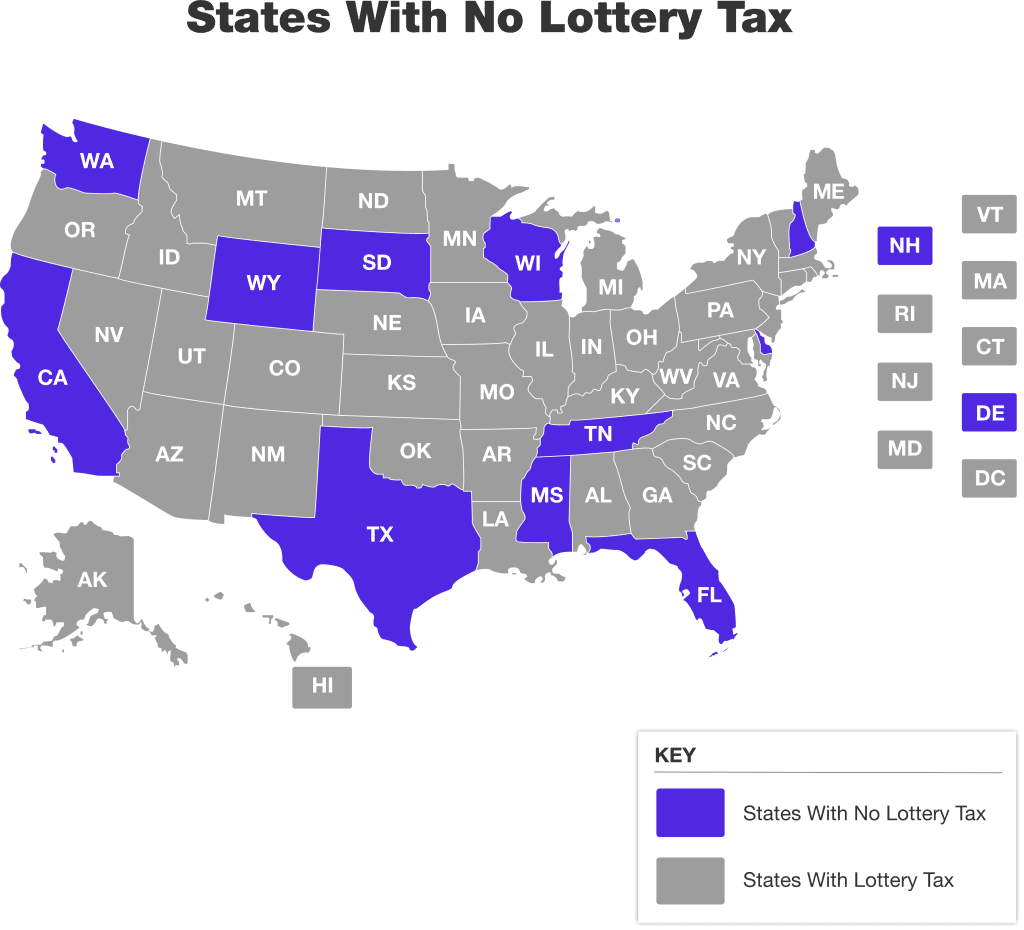

Surprisingly, although California has the highest income tax in the United States, it doesn’t tax lottery winnings. Other states with a state income tax that don’t impose any lottery taxes are Mississippi and Delaware.

The best states to win the lottery include places where there is no income tax and Powerball and Mega Millions can be played.

The no-income-tax states and states that don’t tax lottery winnings are truly the top places to win a jackpot, but of the states that do include winnings in taxable income, here are the five with the lowest tax rates:

With an income tax rate of 4.55% on lottery prizes, this mountainous state lets you keep far more of your winnings than most states.

With an income tax rate of 3.23% on lottery prizes, Indiana is a great place to win Powerball.

With an income tax rate of 3.07% on lottery prizes, this makes the Keystone state one of the best places to win a jackpot.

With an income tax rate of just 2.90% on lottery prizes, North Dakota is the closest thing to South Dakota’s 0.00%.

Congratulations to residents of Florida, South Dakota, Texas, Tennessee, Wyoming, Washington, California, Mississippi, New Hampshire and Delaware! (California does not tax MegaMillions or the California Lottery only.)

If you’re a resident of Florida and buy a lottery ticket while you’re visiting New York, you’d have to claim the win in New York and file a tax return there. It doesn’t go both ways, though. If you are a New Yorker who buys a winning lottery ticket in Florida, New York will still collect tax on your winnings.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.