8 minute read

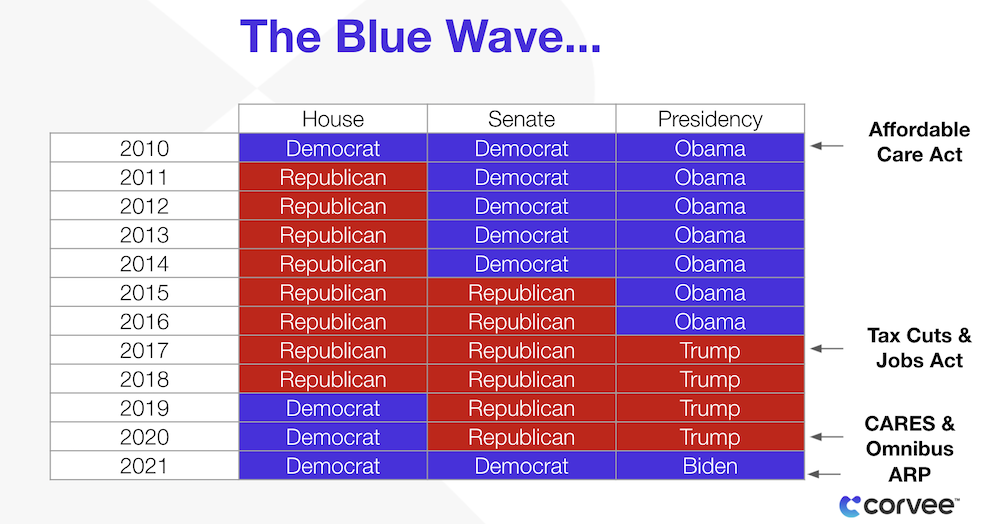

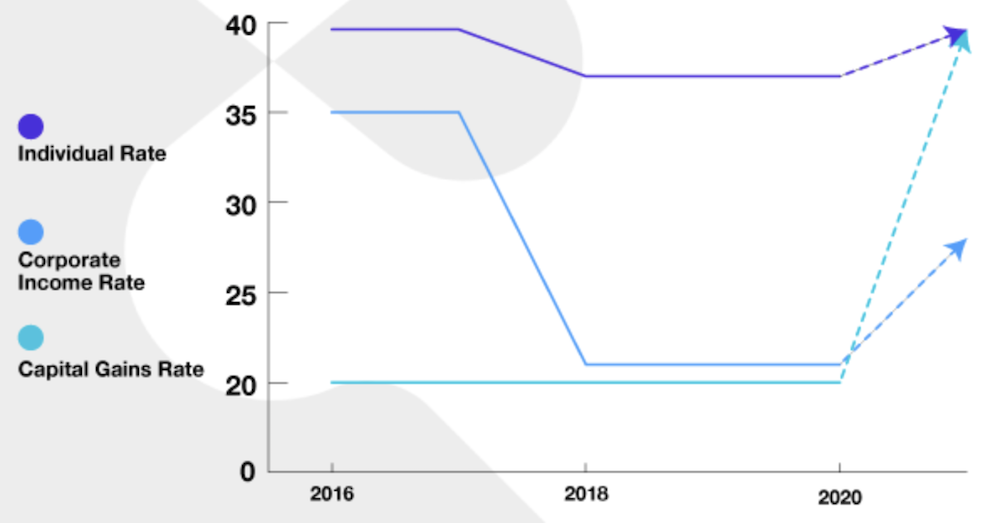

2021 will be a year filled with tax policy changes. Of course, each election cycle brings the potential for new tax changes, and 2021 may be a new era entirely. Whenever you get a red or blue “wave,” chances are that impactful new legislation will be released:

2021 is a game-changing tax year, which means tax planning can’t wait until the end of the year. The planning opportunities are huge for 2021, and many people will be paying higher taxes. Hence, more people will be looking for ways to save on taxes.

End of year tax planning for 2021 is coming soon, and your clients will need tax planning strategies to help lower their tax burden as rates increase. Are you prepared to help them?

There are many tax planning strategies that can save your clients money, but what are some of the most basic ones?

Well, usually basic strategies are used because they are easy, which means these strategies (retirement plans, corporate restructurings and insurance plans) are things prospects have heard of before and may even be familiar with as a means to save on taxes.

One of the more popular tax planning strategies that can provide a huge impact is retirement planning. A good tax plan should go through and confirm that the client’s retirement plan is the most appropriate one for their situation, whether it’s a 401(k), IRA or SEP.

High net worth individuals fortunately have more opportunities for tax planning than most average W-2 wage earners. When working with these types of clients, you need to go through and analyze their specific situation.

For example, a client with $4M of wage income is most likely going to have investments. For this client, you would want to make sure they are maximizing investment expenses and minimizing investment income tax.

Additionally, clients who invest heavily in securities most likely have the opportunity to take advantage of tax loss harvesting and 83(b) elections. Timing is important. Harvest gains if tax rates are going to be higher in the future and delay losses to offset taxes once rates rise.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

While there are tax savings strategies available to individual clients, there are also a multitude of strategies available to business owners. When considering your business clients, here are some popular business tax planning strategies you can be using as we approach year end tax planning for 2021:

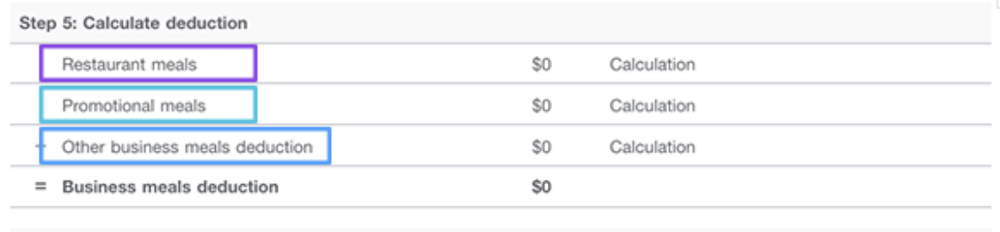

To take just one example, let’s look more closely at the 100% deductible meals, which was part of the 5,593-page Coronavirus relief package. If you have tax planning software, you can easily do these calculations in minutes, even breaking down the different types of meals to easily calculate the total deduction for this strategy.

This is just one of the new updates we are constantly implementing into our software to make 2021 year end tax planning easier.

With such substantial tax law changes happening, tax planning will be more difficult in 2021 and 2022 for many tax planners. For those who don’t rely on technology, they’ll be doing the best they can to accurately calculate the tax savings given what they know—but it becomes much more difficult when considering multiple entities or years. For example, what is the actual tax savings in 2021 and 2022 when each strategy adds deductions and lowers taxable income across tax rates?

For this reason, many tax firms are turning to Corvee to help handle year end tax planning 2021. It speeds up the process, streamlines workflows and calculates over 60 strategies automatically for each of your clients.

With so much change, it’s difficult to keep track of it all. New bills have been coming out at a fast pace since the pandemic began in 2020. The need for accountants to go beyond tax preparation and tax projections, and to start tax planning has never been greater.

Don’t wait until December to start tax planning. You can create value for clients throughout the year simply by showing them how much you can save them.

Even the most basic deductions will still save clients money if they’re not taking them, and that is what matters. It’s not the complexity; it’s the result.

Many tax firms are adding tax planning to their service menu in 2021 with all the recent legislative changes. They are often charging clients between $4,800 – $9,800 based on potential estimated tax savings. They can easily find themselves selling upwards of 15-20 tax plans per month doing things for clients such as ensuring they are:

The software also enables more complex tax planning with the ability to calculate over 60 strategies simultaneously with thousands of possible combinations to save more money.

Having a more efficient entity structure is one of the easiest ways you can help a client during year end tax planning for 2021. Approximately 75% of small businesses are organized as a Schedule C, but it rarely makes sense for a business owner to remain a Schedule C. By moving them over to an S Corporation, Partnership, LLC, or even C Corporation, you will often be able to significantly minimize their taxes going into 2022.

For more on how you can begin using technology to tax plan, schedule a demo with us today.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.