10 minute read

The concept of cryptocurrency has been around since the 1980s, but specific currencies and the blockchain technology that track

them only made their way into mainstream media about a decade ago. Public interest has waxed and waned since then, but at the beginning of 2021, we saw interest (and coin prices) soar once again. But coin prices are extraordinarily sensitive to changes in the market and public perceptions. Just this month, new restrictions from the Chinese government, new revelations about how bitcoin mining affects the climate, and Elon Musk’s tweets have moved coin prices all across the board, making cryptocurrency investment anything but stable. Early investors in cryptocurrencies have certainly made a killing, though. Bitcoin, for instance, was selling at $1 a decade ago but sold for $56,000 on May 1, 2021. Many people who invested in Bitcoin and other popular currencies are looking at large investment gains. When virtual currencies first became available, the IRS had little to say about them, but today it’s clear what activity is taxable. Learning how the IRS views cryptocurrency is important so you can adjust your tax plans for your activity. If you have a good quality tax planning software, you can build those assumptions into your plan to prepare for and manage your tax liabilities.

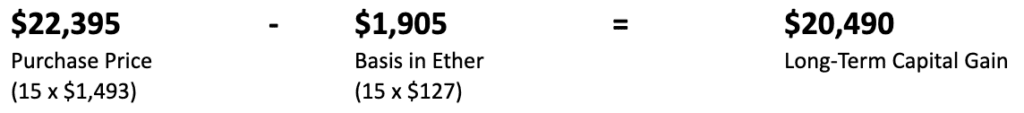

On January 1, 2020, Taxpayer purchased 15 Ether at $127 each, totaling $1,905. On March 1, 2021, they sold all 15 Ether for $1,493 each, totaling $22,395. On their 2021 tax return, they should report a long-term capital gain of $20,490.

Assuming their capital gains are taxed at 20%, they will have an additional income tax liability of $4,098.

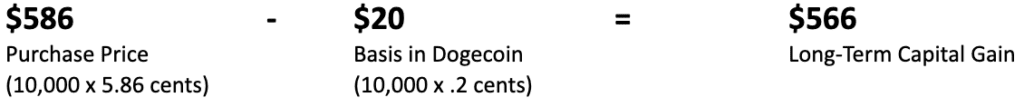

On January 1, 2020, Taxpayer purchased 30,000 Dogecoin at .2 cents each. On March 15, 2021, they used 10,000 Dogecoin to pay for a ticket to a Dallas Mavericks NBA game, who now accept some cryptocurrencies as payment methods. On that date, Dogecoin was trading at 5.86 cents. On their 2021 tax return, they should report a long-term capital gain of $566.

Assuming they are subject to a 20% capital gains tax rate, they will have an additional income tax liability of $113 for using Dogecoin to pay for a Maverick’s ticket.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

When calculating your gains and losses from cryptocurrency sales, you’ll need to know which assets you’re selling so that you know which basis to use in your calculations. Should you identify assets using a first in, first out (FIFO) method? Last in, first out (LIFO)? What about highest-in, first out (HIFO)?

The IRS gives us some guidance in their Frequently Asked Questions (FAQ) document. This document states that, for tax purposes, taxpayers can select which assets they sold. This allows you to optimize your gains/losses based on your cost basis in each asset. To identify assets, your must have records that show:

Most of this information is tied to the asset’s private key, but if information like basis is not known – like if you received an asset as a gift or through nontraditional means like a hard fork, an airdrop, or mining – or if you simply opt not to specifically identify the assets included, you must default to a FIFO method for determining which assets have been sold.

Not all cryptocurrency activity is as straightforward as the examples we shared. Fortunately, the IRS provides clear information that can help ensure you’re reporting your activity correctly. Here are a few things you might want to know.

No. Moving virtual currency between wallets is not a taxable event. It’s important that you look at your virtual currency activity because exchange platforms may flag a wallet-to-wallet transfer as a disposal. You will need to judge for yourself whether that transaction is taxable.

Hard forks and soft forks can be taxed differently.

Hard forks occur when your cryptocurrency changes protocol, resulting in a permanent diversion from the original distributed ledger (i.e. a new currency is created). Revenue Ruling 2019-24 discusses the tax consequences of hard forks. In general, hard forks are nontaxable events. Owners of the original assets will not recognize income from the assets held in the new ledger because they have no ownership over those assets.

However, if your hard fork is followed by an airdrop, you will need to recognize income. An airdrop occurs when units of the new cryptocurrency are transferred to the owners of the original currency. Airdrops may follow hard forks but don’t always. When an airdrop occurs, the taxpayer will record the fair market value of the recently-acquired new currency as ordinary income on their tax return. Soft forks are different; soft forks happen when a distributed ledger undergoes a protocol change, but no new ledger is created. Soft forks have no tax effects.

Yes. If you gifts cryptocurrency, the gift tax rules would apply as if you gifted any other capital asset. The fair market value can be determined using the trading value of that asset as of the date of the gift. The recipient will not need to report the gift as income.

Sales of virtual currency should be reported on Form 8949, Sales and Other Dispositions of Capital Assets. You will also need to check a box on the front page of Form 1040 that indicates you sold or exchanged cryptocurrency. This is a new question on the 2020 version of the form.

Now that tax compliance season is over, it’s a good time to shift into tax planning. Like other capital assets, your cryptocurrency investments can be great tools to use when building a tax plan. If you’re precise, you will be able to time your virtual currency sales in the year that makes sense from a tax planning perspective. For example, if you are holding onto losses and looking to get rid of your investments, you can determine the optimal time to recognize those losses. I you have both gain and loss positions and seeks to cash out part of your holdings, you can also use asset identification to reduce the tax impact of generating needed cash. Corvee’s tax planning software can show you what their 2021 and 2022 tax positions will look like so that you can select the best year to initiate the sale. Our software also generates an easy-to-read deliverable for taxpayers who don’t specialize in taxes. You’ll be able to see in dollars how much tax strategies will save you.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.