10 minute read

What does the future of accounting look like? Will it be in expanding compliance services, doing more month-end reconciliations for more clients with the help of new technology? Will there be a strong shift toward multi-service firms, delving into tax returns, financial coaching and wealth management?

Suffice it to say, the days of being a sole practitioner “bookkeeper” are a thing of the past if you want to have a profitable accounting firm. While many firms are beginning to switch to offering advisory services, such as Chief Financial Officer, the accounting firms of the future are focusing on tax planning as an entry service for new clients, which they can upsell into CFO services, monthly accounting and other packages. Software for accountants will also play a larger role.

First off, you don’t need to be a CPA or have any specific license to sell tax plans. And while tax planning can seem intimidating on the surface, the truth is that you don’t actually need to learn all 70,000+ pages of the tax code. In fact, all you need to know to get started is to learn roughly 20% of the “workhorse” strategies that typically can be applied in 80% of all cases with your clients.

So, the barrier to entry is low, meaning almost any accountant, with proper motivation and the right information, can get started offering tax plans to clients in a relatively short time period. With the right coaching and tools, you’ll get all the ins and outs of tax planning from the first phone call with a prospect to pricing, packaging and delivering the final tax plan to your client. Software for accountants can automate much of this for you.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

While tax preparation is more compliance-focused, tax planning, along with tax planning software, moves beyond the current year and looks to save a client money for every year going forward. While it may not seem time sensitive, it is extremely important.

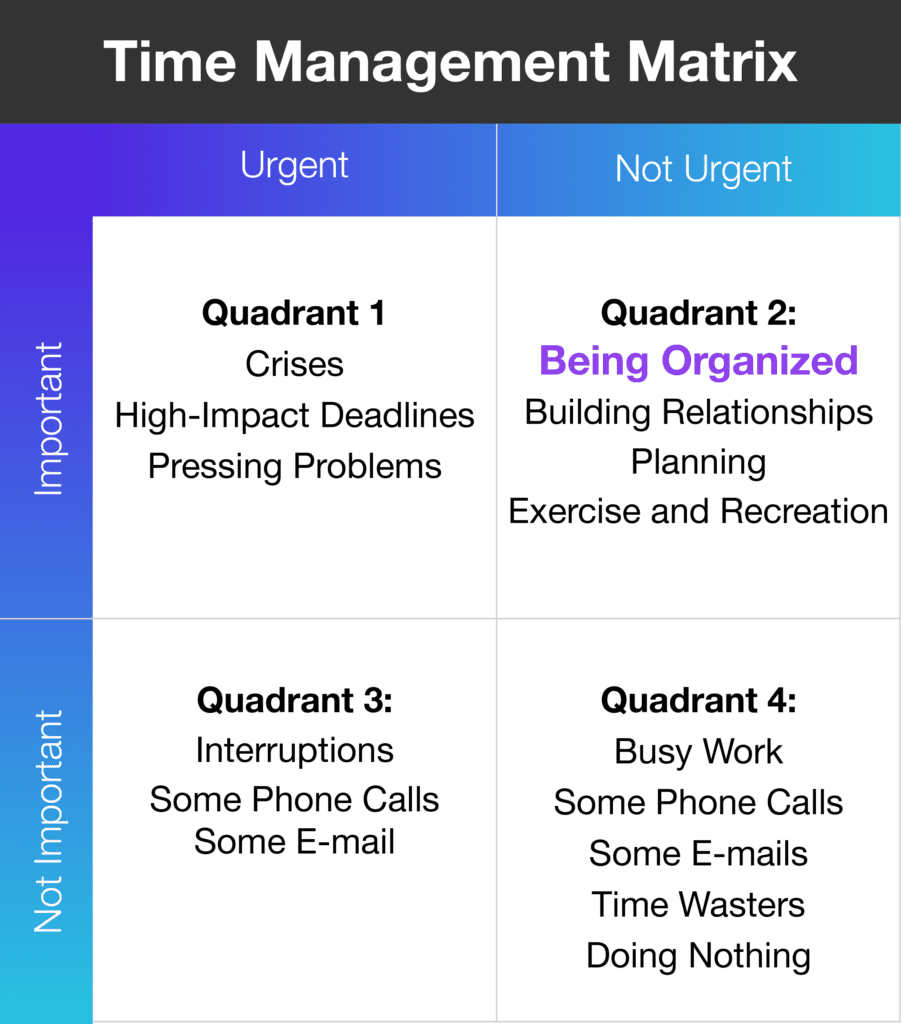

One way to look at it is to consider the popular time management matrix, which looks like this:

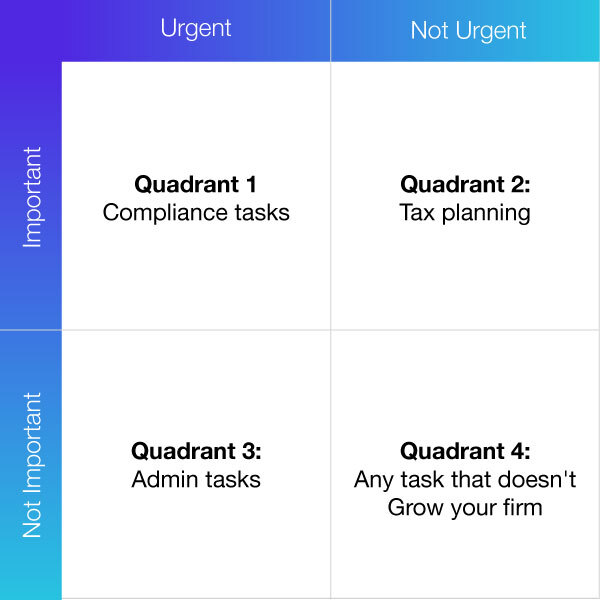

In this popular time management matrix, the best use of our time in life and business is in Quadrant 2—the important, yet non-urgent tasks. If we were to make a similar “Accounting Matrix” for your time spent in your firm, it would look like this:

Many firms are spending all their time inside Quadrant 1 (urgent and important tasks of doing tax returns and monthly reconciliations) or in Quadrant 3 (chasing documents back and forth with clients).

While it’s true that compliance work comes around like clockwork and deadlines must be met, it’s not the quadrant that can bring your firm the biggest benefits. Neither should Quadrant 3 (admin tasks) fill your time and energy during the day. Those should be delegated to staff.

Tax planning never seems too urgent, but it’s of vital importance. While tax prep is mostly data entry and form filling, tax planning oftentimes saves people over tens of thousands of dollars every year. When you look at the typical tax plan, you’ll see that if your client invests the money they could save on taxes and calculates it out to the age of 65, tax planning can easily be the difference between a nest egg of $500K versus a 7-figure nest egg.

This is why tax planning and tax planner software is the future of accounting—you’d be hard pressed to find another service that your firm can do that provides as much value to the client while giving you a healthy profit margin because firms can typically charge $2,500 to $9,800 per tax plan (not counting implementation of that plan, which would be an extra fee).

At the end of the day, the value you are bringing to a tax planning engagement is providing the client with the knowledge of how much money they can save in taxes if they restructure their life and business in a certain way.

Almost every single company in the US is overpaying in taxes in some way. Many business owners have never been informed of the possibility of saving on taxes and have never worked with an accountant who has walked through their specific situation to see what they could save by implementing relatively minor changes in their lives.

Many professionals who begin tax planning start from a tax preparation environment. At times, these tax preparers have been working with low-paying clients who lack gratitude and often they feel taken advantage of. The value tax preparers have been offering their clients is also moderate to low because they are not charging enough to be able to provide tax planning services to help clients save money on taxes.

Therefore, when you make the decision to make tax planning a significant focus of your business, or even the sole area of focus, you must also decide what other services you are going to offer, if any. Generally, 80% of tax planning clients will work with you on tax preparation and 40% to 50% of tax planning clients will work with you on other service offerings, be it implementation, quarterly maintenance and support, financial services or monthly accounting.

You do not have to make the decision of what services to provide at the outset. Some of the most successful and profitable individuals who do tax planning focus solely on tax planning at the beginning and wait before making the choice of offering other services. It is entirely possible to build a business earning upwards of $10 million in annual revenue doing solely tax planning. Any services you decide to add on the back end, such as tax preparation, will most likely double the business.

That being said, once you have helped an individual save $10,000 or more on taxes, it is much easier to negotiate a higher tax preparation fee than they would otherwise pay, since even with the higher fee, they will still save money working with you. This allows you to earn much better margins on the tax preparation work than you would if you only offered tax preparation.

The good news is, you don’t need to attempt to navigate your way into tax planning on your own. Why try and spend time and energy figuring it out through trial and error when we’ve already spent years perfecting the tax planning process? Corvee Tax Planning software can help you scan tax returns, collect information from questionnaires, analyze estimated tax savings, prepare proposals and finalize tax plans for clients in minutes.

In short, with the tools and coaching that Corvee provides, you don’t need to have much, if any, prior experience in tax planning to begin providing this valuable advisory service to clients. Our software for accountants will help to automate much of the process for you, and our growth and development programs teach you the strategies and process to put it all together. This way, you feel confident from your first sales call to the final delivery of the tax plan to your client.

For these reasons, we believe tax planning is the future of profitable tax and accounting firms and the best possible service to begin offering your clients in 2020 and beyond.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.