12 minute read

The second article in our Deep Dive into Entity Selection series focuses on tax for partnerships.

A partnership is a legal designation for a business that is owned by two or more taxpayers, but the term “partnership” also refers to a taxing entity. Businesses that are legally considered partnerships must file the partnership tax form, Form 1065. But other business entities may also need to file partnership tax forms. Limited liability companies (LLCs), for example, must report their activity on Form 1065 unless they elect to be taxed as corporations.

All 50 states permit individuals to establish partnerships. If you have a good tax planning software, you will understand how partnerships are taxed, but there is still so much to understand about partnerships as legal entities. Each state’s offerings differ, but most states recognize the following types of partnerships:

General partnerships are established when two or more individuals agree to form a company. All partners share the profits and liabilities of the business, and all partners have the authority to contract business on behalf of the business. The ownership does not need to be equal between all partners, but all partners in a general partnership are personally liable for the business’s debts.

A partnership agreement is not required, although it may be advisable to draft one.

Limited partnerships are like general partnerships in that (1) they are established when two or more individuals agree to form a company, and (2) those individuals share the profits and losses of the business. Where limited partnerships differ is in the recognition of liability.

A limited partnership has two levels of partners: general partners and limited partners. General partners are the only partners with managerial authority over the business, which also means they are the only ones personally liable for the business’s debts. Limited partners are typically involved in the partnership for investment purposes only. They have limited authority to bind the company into new contracts, and their liability is restricted to the amount of their investment.

A partnership agreement should be filed with the state to outline each partner’s roles and responsibilities.

Limited liability partnerships (LLPs) are the best of both worlds. LLPs allow all partners to make managerial decisions, but they also provide some protections against liability. Each state protects LLP partners differently, so it’s important to understand the LLP laws of your state.

Like limited partnerships, LLPs require a partnership agreement to be filed with the Secretary of State.

Limited liability companies (LLCs) are not legal partnerships, but they are recognized as partnerships for tax purposes. Because LLCs provide the most protection against liability for its members, you will likely need to file a partnership tax form on behalf of an LLC at some point, so it’s good to become familiar with the LLC laws of your state.

Like limited partnerships and LLPs, LLCs require filings with the secretary of state, although instead of partnership agreements, they file operating agreements.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

General partnerships are not required to register their business with their state. When two or more individuals agree to do business with one another – whether informally or with a partnership agreement – a general partnership is born. If they want to conduct business under a separate name, they would be wise to file a fictitious name certificate with their Secretary of State.

Limited partnerships and LLPs are different. In almost all states, individuals who wish to establish a limited partnership or an LLP will need to register their business with the Secretary of State, file annual informational returns, and formalize their partnership agreements. The most common items to include in partnership agreements are:

The partnership agreement is the most important document you will create. They are legally binding contracts, so you should contact an attorney when drafting the agreement.

Liability in general partnerships is unlimited, which means that business owners’ personal assets are not shielded from the debts of the business. This liability is why many business owners choose to form limited partnerships, LLPs, or LLCs. Limited partnerships provide liability protection to the limited partners; LLPs provide some liability protection to all partners; and LLCs provide the highest level of protection to all members. The specific protections vary by state.

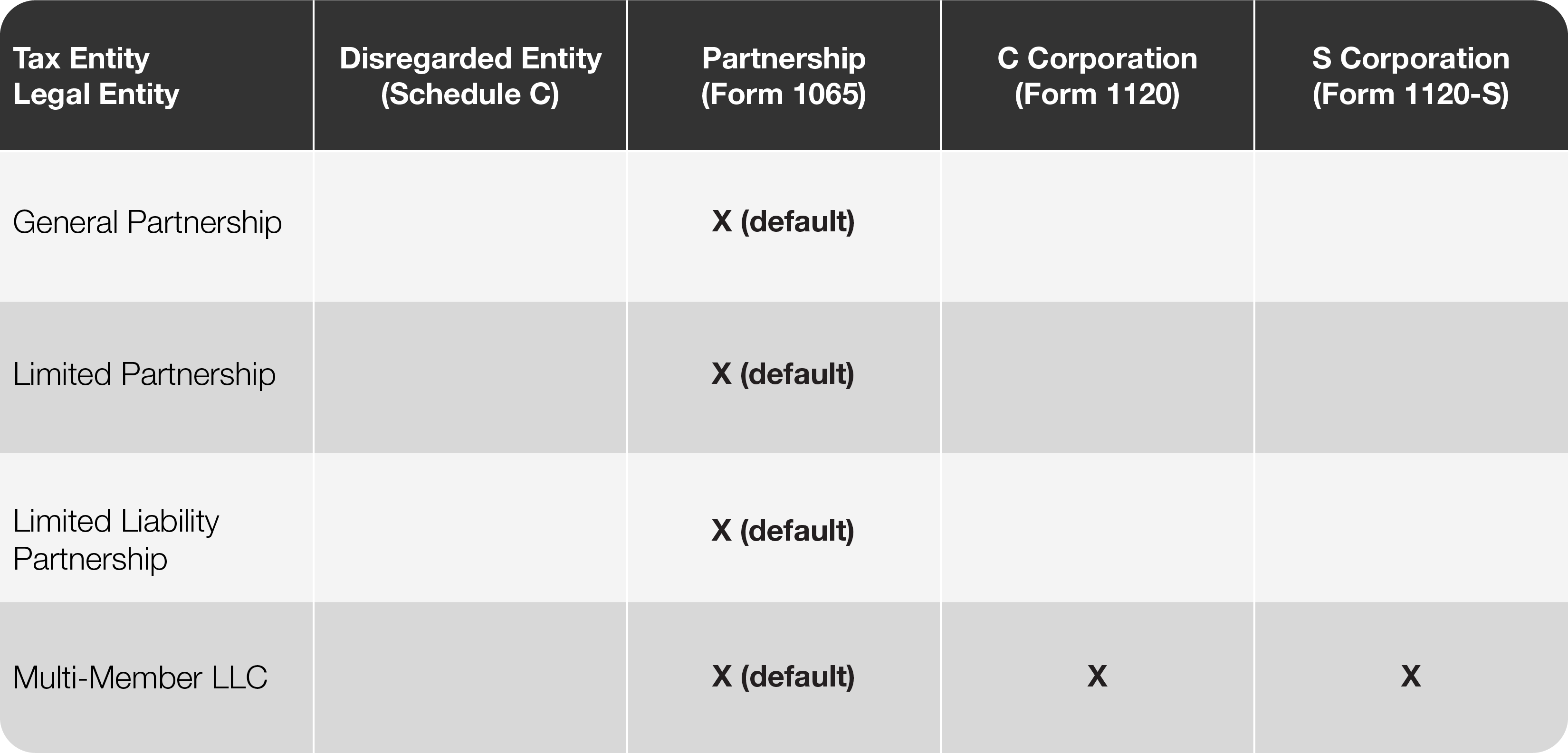

Each of the four business entities listed below will be taxed as partnerships by default. However, multi-member LLCs have the option to be taxed as C or S corporations.

Partnerships are not taxpaying entities. Business earnings are reported on Form 1065, but those earnings flow down to the partners. This means that partnerships are only taxed once: at the partner level.

Form 1065 is an informational return that reports non-financial details of the partnership, a balance sheet that reflects partners’ capital accounts, and income and expense activity for the partnership as a whole. Each partner’s distributive share of this data is reported on Schedule K-1, which is the form you use to prepare your individual income tax return.

In addition to reporting the partnership activity on your individual income tax return, you will need to think about:

A few advantages that partnerships have over other business forms are:

Sharing start-up costs may be the only way for some businesses to get off the ground.

Taxable income and other tax attributes do not need to be distributed in the same percentage as each partner’s ownership. The partnership agreement can dictate which attributes are reported to which partner.

If the partnership agreement allows for new partners to join, adding a partner can be a technique to raise capital.

With more than one owner, especially if there is more than one partner that makes managerial decisions, individuals can share the burden of operating a business with others they trust.

Not all aspects of partnerships are positive.

Depending on the type of legal entity, how the partnership agreement is drafted, and the laws of the state, partners may be liable for the actions of other partners, and that liability may even extend beyond their investment.

Typically, a new partnership agreement must be adopted when a partner leaves or a new one is added.

Depending on how the partnership agreement is drafted and what buy-out agreements are in place, it can be costly to the remaining partners when one wishes to leave.

Because a partnership is an agreement between specific individuals, it is not easy to sell partnership interests. And because partnership interests are not listed on a public marketplace, they can be difficult to value.

Entity selection is never black and white, and it can be difficult to know what entity you should create. Fortunately, Corvee Tax Planning software can help you decide. Our software is dynamic, so you can see how much money you would save if you formed a partnership versus an S corporation, or a C corporation versus an S corporation. Taxes are only one piece of the puzzle, but they will have an impact and should be considered before a business gets off the ground.

Even if you are already operating a business, our tax planning software can help you see how your tax position would change if you dissolved your business and reformed as a new entity.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.