10 minute read

Having a great accounting sales process is key for accounting firm growth. If it were simple, every accounting firm would be successful—and the truth is an efficient accounting sales process has more components than you might expect. This blog covers some of the biggest areas of concern you should consider when analyzing your accounting sales process for your firm.

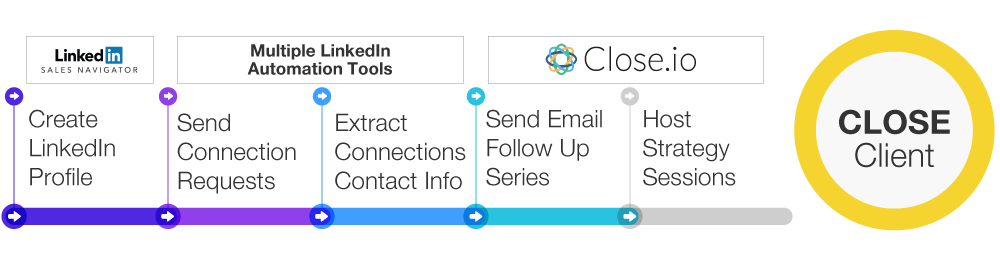

The first step of an accounting sales process is to find leads. While most accounting firms rely on referrals (and you should definitely pursue referrals) the problem is when you don’t pursue leads beyond your referrals. We suggest starting to generate leads on LinkedIn, and we have a specific process we follow to make it as smooth as possible.

The point being, LinkedIn is where you should be starting. There are so many high quality business leads on this platform, you are losing market share to other accounting firms simply by not being on here. Remember, without leads coming in, you will have no sales!

Getting leads for your firm is one thing, actually making an appointment with them is another. For accounting firm growth, we recommend using a software to automate some of this process because it can become a bit tedious sending out LinkedIn connection requests or messages each week.

About 20% of the appointments that our accountants get on LinkedIn come from viewing profiles, and about 80% of the appointments come from connection requests. Done right, you can potentially get 5 to 7 (or more) appointments a week very consistently. How many appointments with potential clients are you getting right now each week?

A verbal phone call is a difficult way to sell someone because you are working without any visuals. People generally believe what they see, not just what they hear. When you have an appointment with a prospect, whether through LinkedIn or any other method, we advise using a Zoom call and have a prepared sales deck to walk the person through what you do, your value proposition and how they can benefit from your services, and then a very clear, compelling offer.

We have ready-made, proven sales decks that convert for tax planning, CFO services, and more. Of course, if you don’t use ours, you will need to create your own. The point is that you DO need a sales deck if you want to optimize your accounting sales process.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

A final, yet extremely important step in the sales process is getting the closed deal secured by actually receiving money. Many of our accountants are now using an accounting software tool called Corvee Tax Planning, which easily allows you to send and receive documents with clients even when on a Zoom call.

Here’s what we found: when you are on a call and about to close a deal, you have to send them an engagement letter to sign, which means getting off the call and waiting. Not with Corvee. You can quickly send documents such as engagement letters electronically so you don’t even have to get off the call. You can go through and then have them sign your documents and pay all on the same software platform.

Practically speaking, this means more money up front and a quicker process to close deals. Why send invoices and wait days, even weeks for clients to give you payment when it can be done easily within minutes using software tools built for accountants?

“Strengthen your accounting firm by strengthening your sales process.”

– Andrew Argue, CPA

This has been just a quick overview of some of the steps your sales process should include, encompassing broad lead generation down to the exact moment when you ask for the money. While developing a strong accounting sales process for your firm may be intimidating, it is vital for future growth and success.

Do you have a process for consistently getting new leads?

This requires much more than just a referral program or cold calling. If you’re not doing something to generate leads online, your firm is missing out on opportunity. It doesn’t even have to be LinkedIn as discussed above, we have many accountants that are successfully using Facebook Ads to generate leads!

Can you move potential leads into the next phase and get them interested enough to meet you and discuss your services?

Unfortunately, if lead generation was everything, you could just make a TV commercial and call it a day. What’s your process from moving a person from awareness to interest?

Have you ever even taken the time to make a sales deck?

If the answer is no, ask yourself why that is. Likely, the only logical answer is that you haven’t valued sales enough, or have lacked an understanding of how critical a solid overview of your service and offer is to present to clients. Fix this oversight!

Do you wait on getting engagement letters signed and payments received until you’ve hung up with a potential client?

If you wait more than 15 minutes, that’s too long—a day is ridiculous, and a week or longer is insanity. We are not just creating hyperbole here. You really need to take time out of the equation and STOP waiting so long to close deals by emailing back and forth (or worse, snail mailing invoices) and billing on the backend rather than up front.

Most $1M+ accounting firms have a well-developed accounting sales process they follow. If they didn’t have one, they wouldn’t be million dollar firms. So, if you are finding yourself plateaued, regressing or just not expanding as rapidly as you hoped you would…accounting firm growth is still possible but it’s likely something is OFF in your accounting sales process.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.