5 minute read

Paying taxes is stressful enough for most taxpayers, but for small business owners, it can be quite a herculean ordeal to determine all the different taxes and payments that have to be made! There are payroll taxes, estimated payments, self-employment taxes – and that’s just on the federal side! Many states have also now introduced the ability for pass-through entities to voluntarily pay taxes directly, which may have many of your clients asking, “should I pay taxes on my pass-through entity?”

Usually when a new tax is created, it’s not a cause for celebration. That’s not the case with the new elective pass-through entity (PTE) taxes – in this situation, taxpayers and advisors were cheering! This is because these new tax options were created to make what is referred to as a “SALT cap work-around.”

When the Tax Cuts and Jobs Act passed in 2017 it limited the ability for taxpayers to deduct their state and local taxes (or SALT) paid to $10,000 or $5,000, depending on their marital status. Your state taxes include income tax, personal property tax, real property taxes, and/or sales tax, depending on which state you live in. For taxpayers who live in high tax states such as New York or California, the SALT cap severely limited their federal itemized deductions and greatly increased their taxes.

States immediately began looking into ways to create work-arounds to these caps. Some states with high property values and taxes attempted to re-work these taxes paid as “charitable deductions.” Other states allowed their residents to prepay their taxes to take the large deduction in the year the taxpayer filed. Unfortunately, these options were either not allowed by the IRS, such as the charitable deductions, or limited to one year, such as the prepaid taxes option.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

As the name suggests, pass-through entities work by “passing on” the income, deductions, credits, interest, dividends, etc. to the owner without paying an entity tax the way a C corporation does. Instead, the owner-taxpayer reports these items on their own individual income tax return. The taxpayer then uses the income, deductions, and credit to determine their federal and state income tax liabilities. This means that the taxpayer will be limited under the SALT cap if their state tax liability is above the allowed amount.

Connecticut was the first state to implement a pass through entity tax as a way to allow taxpayers to get around the SALT cap. The entity pays the state tax liability, which it can then use as a deduction. The deduction flows through to the taxpayer and reduces the total income reported. By paying tax at the entity level the taxpayer is less likely to bump against the SALT cap on their individual tax return.

Let’s look at an example. Suppose Pam and Jim are married, live in New York, and own an S Corporation together. In 2022, the S Corporation made $500,000 and had deductions of $100,000. They will report the income, deductions, and credits on their individual tax return. Their net income would be $400,000. In New York State, their state income tax alone would be about $23,000.

With the SALT cap limitation, Pam and Jim would only be able to take $10,000 on their itemized deductions. But if the pass-through entity pays the taxes; that tax paid is then deducted by the entity itself. The net income of the entity will be $377,000 for federal purposes; and Jim and Pam will get the credit or income exclusion for the taxes paid on the state side.

A hallmark of a passthrough entity is that it is not subject to a separate entity tax, unlike C corporations. In keeping with that spirit, most states have crafted their pass-through entity taxes to be equal to the highest individual income tax rate. For instance; California’s pass through entity tax is 9.3%, which is their highest rate. Maryland’s is unusual, as it combines the highest state individual income tax rate of 5.75% with the lowest county tax rate of 2.25%, for a total tax of 8%.

Not every state has implemented a pass through entity work around. And not every state that has one makes it mandatory. In fact, Connecticut is the only state so far that has made a pass through entity tax mandatory. Since the idea of an elective tax had not gotten approval from the IRS, Connecticut made theirs mandatory to add validity to it. However, in 2020 the IRS released Notice 2020-75; which indicated the IRS would allow states to implement these work-arounds.

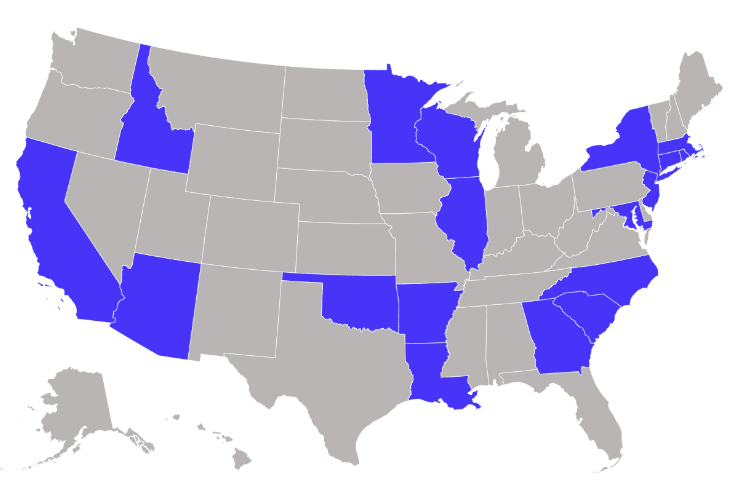

Currently, 21 states have some form of a pass through entity tax.

| States | States |

|---|---|

| Alabama | Maryland |

| Arkansas | Minnesota |

| Arizona | New Jersey |

| California | New York |

| Connecticut | North Carolina |

| Georgia | Oklahoma |

| Idaho | Rhode Island |

| Illinois | South Carolina |

| Louisiana | Wisconsin |

| Massachusetts |

Other states have legislation that has been introduced or is pending, including: Iowa, Mississippi, Ohio, New Mexico, Pennsylvania, Utah, and Virginia.

Not every pass through entity should immediately elect to pay taxes on the entity level. There are many reasons it does or does not make sense to make this election. And remember, the election is irrevocable once made; and is binding on all partners, members, or shareholders of the entity, with few exceptions!

The taxpayers who benefit the most from the elective tax are high income individuals living in high tax states. New York, New Jersey, and California were all states that lobbied very hard against the SALT cap deduction being implemented, as they have both higher income taxes and higher property values. A business where all the members have equal ownership and live in the same state would also be a prime candidate.

There are several things that should be considered before making the election. If there are multiple owners, you need to ensure that electing a tax won’t run afoul of operating agreements if it looks like the election would disproportionately benefit some owners over others. You’ll also want to carefully consider what the administrative or legal burden could be for electing the tax. If it is a small business with one or two owners and little overhead, would organizing as an S corporation or a formal partnership and adding additional administrative and accounting burdens cost the business more money than they would save in taxes?

Finally, if the entity has non-resident owners or members, you will want to look carefully at what the consequences could be if the state does not allow a resident taxpayer to claim a credit for their share of taxes when they are paid to another state by the entity.

If you’re looking to optimize entity taxes and formation, Corvee tax planning software can help you maximize tax savings. In addition, it considers over 1,600 other tax planning strategies you may qualify for.

Learn more about how you can reduce your taxes with Corvee and ensure your business doesn’t overpay in taxes. See how Corvee can help.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.