12 minute read

How much do you want to increase your accounting firm’s revenue every single month? Do you have a big goal? Do you have ANY goal? The truth is, many accountants don’t have specific revenue goals, so they have no reason to push themselves in sales. Big revenue goals require better pricing, packaging, and talking to more prospects—and it may mean stitching the entire focus of your accounting firm from compliance work such as tax returns and bookkeeping to advisory services like tax planning or CFO services!

From now until you retire, what will be the biggest annual revenue you plan on hitting?

Do you know what this number is? The reason why this question is so important has to do with INTENTION. If you do not identify a number, then you are not even looking for the things that relate to that number, the things that may even help you in achieving accounting firm growth.

Here’s an example. If you have 3 kids, and you head to the mall, you may tend to notice all of the kid-related stores. Teddy bears, Legos, the Disney store, etc., but if you are walking into that same mall and you are an entrepreneur, your focus may be instead on the different businesses that are operating and which stores are no longer in business.

This is important to recognize because if your life isn’t built around a certain set of objectives, then even if the answers to your questions are sitting right in front of your face, you’re going to miss them. The same accounting entrepreneur that wants to do $1M on their practice vs $10M vs $100M, they are going to notice different things. There are individuals and companies performing at each of those levels, and it is possible to hit those goals.

That’s why it’s so important to get this question answered, because at the end of the day, just as Zig Ziglar once said, “If you aim at nothing, you will hit it every time.”

From now until you retire, what will be the biggest annual revenue you plan on hitting?

Let’s say the biggest revenue year you desire to have between now and 70 is $3M. Your aim should be to hit that as soon as possible. To begin working towards that, your next step is to figure out your current capacity.

As an example, if you’re selling tax plans, how many tax plans can you onboard each month? How many monthly clients (or whatever other key service you have) can you do now? If you’re not using tax planning software and are only able to do two tax plans a week, then multiply that times 50 weeks. So, 2X50=100. That would be your capacity, assuming you didn’t increase capacity throughout the year by using Corvee Tax Planning software and you didn’t lose any clients.

Whatever your accounting firm growth goal is, it shouldn’t be less than your current capacity. You may find that once you do the numbers on your current capacity, if you maxed out your capacity for the entire year, you could be doing $1M. That would still be short of the $3M that you want as your biggest year ever, but now you know what’s realistic in the short term and how far you still need to climb. Others may find that if they simply operate at max capacity, they’d already be hitting even their biggest revenue goals.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

If you’re reading this and thinking, “I offer monthly bookkeeping for $300 a month, I’m already maxed out with 20 clients and $6,000 monthly revenue.” This is where you need to consider pivoting your entire accounting business toward advisory services. Why? Because you can charge more, give your clients more value and grow your business.

Many of your clients want you to do more than just their numbers. They want to know what their numbers mean and what they should change. This is where tax planning and CFO services come into play. Making these higher level advisory services the main focal point of your accounting firm is your best bet to increase your accounting firm’s revenue.

This is because while compliance work is always needed, your clients could likely find someone cheaper than you to just do their tax returns, monthly bookkeeping or AP/AR. What your clients will pay you more for is advice that will save them money and increase revenue. Advisory services command higher fees because they are based on value, not price.

Compliance work can be easily compared between different firms, so it encourages price shopping. A less common advisory service that is harder to find can’t be shopped around so easily. While 25 firms in your local area can give a client a tax return, you might be their only option to do a tax plan that will save them $50,000.

As mentioned earlier, both tax planning and CFO are great high margin offerings you can introduce into your accounting firm if you haven’t already. If you’re too busy offering compliance services to clients, you need to make a change and switch gears.

Keep in mind, however, that once you start doing advisory service, it’s not a “one-size fits all approach” like with compliance work. Where most accountants go wrong is they do not focus on anything, meaning they provide any service to any human being with a pulse. They have neither a niche nor a transformation dialed in, which results in an incredibly chaotic marketing message and marketing plan.

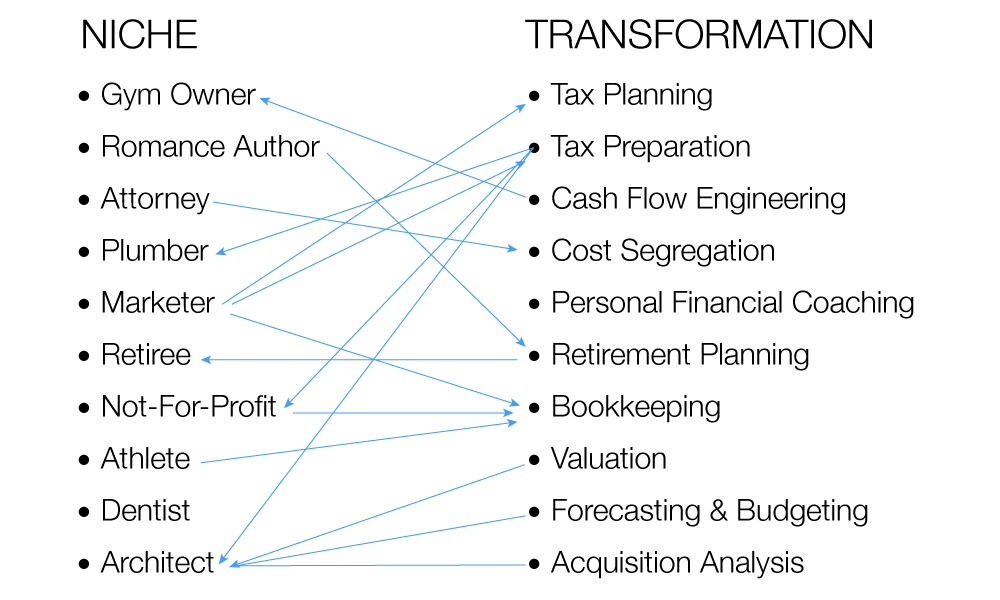

It also results in a sales process where every single sales consultation is customized for that particular prospect and service. The business owner winds up dealing with the following:

However, as chaotic as the graphic is from a marketing and sales perspective, the true devastation to the margins of the business and stress to the team occurs during service delivery. Consider how hard it is to become an expert at delivering one service to one group of people. It is simply not possible for one person to be able to effectively deliver thirty different transformations to thirty different niches in the early days of their business. The result is that you provide mediocre service to many small businesses rather than a high value service to one type of small business.

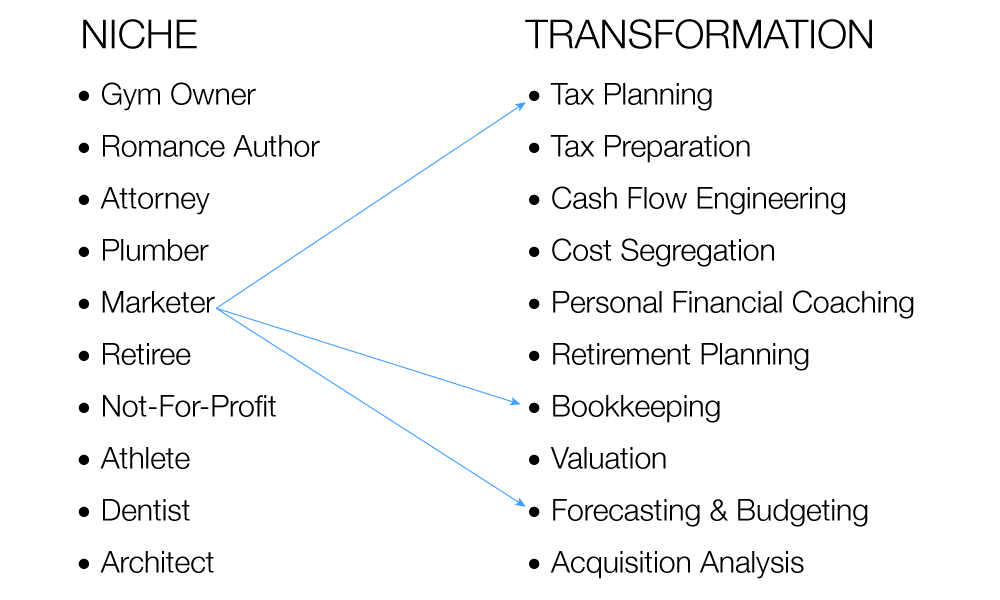

Unfortunately, when many people start their accounting firm, this is where they begin – from a standpoint of how to build a business that makes money and not how to build a great business that provides high value to the clients, owner and team members all at the same time. Therefore, one of the best things you can do before starting out is to pick one specific niche and focus on providing one transformation to that niche. Alternatively, some people do begin correctly by picking one niche; however, they then try to provide multiple transformations to that niche:

While this is a massive improvement over the previous scenario of providing all services to all niches, it is still not optimal. A good example would be an accountant who works solely with real estate investors and provides tax preparation, tax planning, and monthly accounting. The problem with this is that it still does not allow you to truly focus and excel at one type of service delivery and maximize the value you are adding to the client.

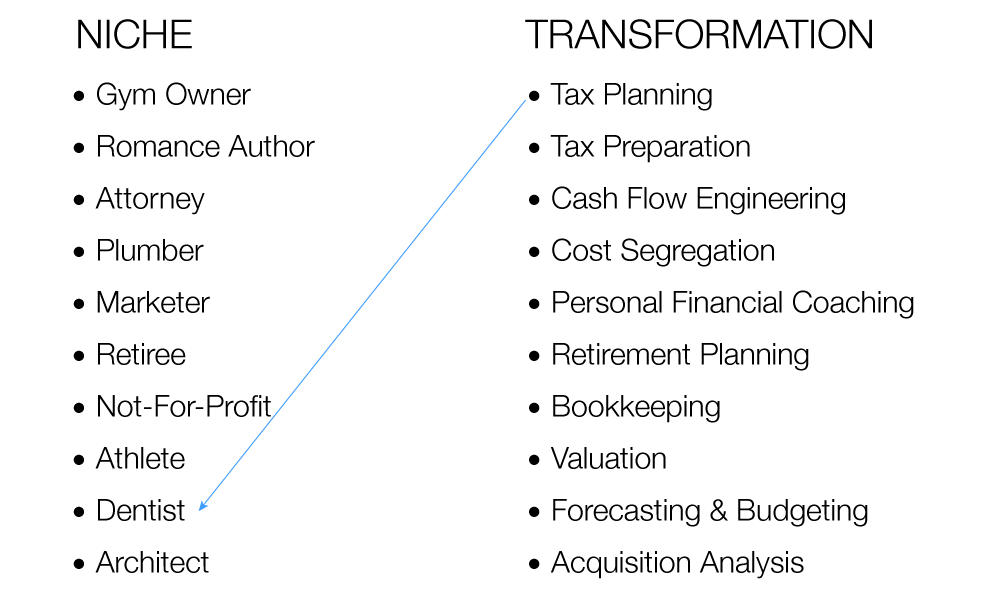

One of the best aspects of a tax planning business and why it is able to be so profitable compared to a tax preparation business is because of the limited focus of how much time you need to spend on service delivery relative to how much value you are able to provide for the client. This is especially true when you use Corvee Tax Planning software to help create your proposals and final deliverables.This next graphic shows how you can take just one transformation, tax planning, and focus on one niche—dentists:

This is by far the best way for you to start whether you are doing tax planning or choose to provide a different service. By focusing on ONE transformation, you are able to develop:

While you may still encounter some customized components for each client, they will be very limited and you will be able to spend the bulk of your time finding ways to create even more value and build your business.

This is the model for you to follow if you want to MAXIMIZE revenue and hit even your most ambitious revenue goals. Start offering advisory services, but offer NICHE advisory services!

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.