10 minute read

Just like mortgages, home equity loans and home equity lines of credit (HELOCs) are loans secured by a personal residence. But home equity loans and HELOCs are different from mortgages in the eyes of the IRS – at least when it comes to deductibility.

The Tax Cuts and Jobs Act (TCJA) placed temporary restrictions on deductions for interest payments on home equity loans and HELOCs beginning in 2018. This restriction could affect your tax return. But before we get into those restrictions, let’s learn a bit more about these types of loans.

A home equity loan is a personal loan that is secured by your residence.

What does this mean?

It means that if you default on your loan, you could lose your house.

Most home equity loans are taken out in one lump sum at a fixed interest rate and must be paid back in a set term. Home equity loans are only available if you have equity built into your home. In real estate, “equity” is the difference between the home’s value and the remaining mortgage.

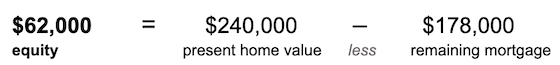

Suppose that five years ago, Sam purchased their house for $220,000. They paid $20,000 down and took out a $200,000 mortgage. Today, they’ve paid down their mortgage to $178,000, and their home’s value has risen to $240,000. The equity Sam has in their home is $62,000.

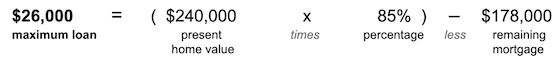

Although they have $62,000 of equity built into their home, their lender will likely not approve a loan for the full equity balance. Most home equity loans are approved as a percentage of the home’s value, less the remaining mortgage.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

Their home equity loan is limited to 85% of their home’s value, less their remaining mortgage. This means their loan can only be as high as $26,000.

A home equity line of credit – or HELOC – is a line of credit secured by your residence. A HELOC is credit you can tap into whenever you need access to cash, like for emergencies, to invest in a new business, to renovate a home, or for any other reason.

Most HELOCs use variable interest rates and are subject to a set draw and repayment period. And like home equity loans, HELOCs are typically limited to a percentage of the home’s value less the remaining mortgage.

With $62,000 of home equity, Same takes out a $26,000 HELOC with a draw period of 10 years and a repayment period of 20 years. This means that they have access to $26,000 of revolving credit over the next ten years, and they must pay back the full balance within 20 years.

Throughout the HELOC’s draw term, you will be charged interest when they’ve withdrawn money from their account. Sam can pay down their balance during the draw period to reduce interest costs, but the funds must be repaid in full by the end of the repayment period.

You might be wondering: Do I have to pay taxes on home equity loans? And: What is the HELOC tax deduction in 2021?

In general, personal loans will not affect your tax return. You do not need to report loan proceeds as income, and you cannot deduct interest payments on those loans. However, the IRS makes an exception for personal loans that are secured by a residence, as is the case with mortgages, home equity loans, and HELOCs.

As it has been for decades, mortgage interest is deductible as an itemized deduction and will be reported on your Schedule A. Interest paid on home equity loans and HELOCs are also deductible on Schedule A, but beginning in 2018, the deductions may be limited or disallowed.

When Congress passed the TCJA, they placed a handful of restrictions on interest deductions for home equity loans and HELOCs. Beginning in 2018, interest on these loans is generally not deductible. However, if the funds are used to “buy, build, or substantially improve” the property secured by the loan – thereby meeting the definition of “acquisition indebtedness” (which remains deductible) – the interest can be deducted. Additionally, the TCJA limited the deduction to interest on acquisition loans (including home equity loans and HELOCs meeting the definition) of no more than $375,000 ($750,000 if filing a joint return). If loans exceed these limits, the amount of interest representing the first $375,000 of loans can be deducted, and the remainder would be nondeductible.

Prior to the TCJA, interest deductions on home equity loans and HELOCs had differing restrictions. First, you were free to use those funds however they wanted – for example, using them to pay off credit card debt or even to finance a personal vacation. Second, interest on these loans (assuming they did not qualify as “acquisition indebtedness) was only deductible up to $100,000. Acquisition indebtedness limits were also higher – at $500,000 were deductible ($1 million if filing a joint return).

The TCJA’s limitations apply to home equity loans and HELOCs that were incurred after December 14, 2017. If you have a home equity loan or a HELOC you incurred before then, you can follow the pre-TCJA rules for interest deductions.

And fortunately, the TCJA’s limitations are only temporary. You will be bound by these rules only for home equity loans and HELOCs they take out from December 15, 2017 through the end of tax year 2025. Beginning in 2026, the rules are scheduled to revert to pre-TCJA law, allowing for greater deductibility of interest on these types of loans.

Home equity loans and HELOCs might be up against deduction limitations for the next few years, but that doesn’t mean they are a bad financial move. Here are just a few reasons you might want to utilize a home equity loan or HELOC, even in tax years when deductions are limited.

The bottom line is that the tax deduction for home equity loans and HELOCs is only one part of the story. You should look at your full financial picture before deciding to acquire or forego one of these loans.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.