9 minute read

The most effective way to grow your tax and accounting firm in 2020 is by making your clients money through tax planning. From there, you can add additional advisory services.

Of course, offering tax planning is quite a bit different than just offering tax preparation. While tax planning is higher-priced (and higher-margin), it also gives clients higher value due to the extra savings you put into their pocket.

The problem for many tax and accounting firm owners is that they don’t have the experience, the know-how or the confidence to begin offering tax planning to their clients. Or, they lack the correct pricing, packaging or delivery to make it successful.

Point being, although tax planning is the number one way to grow a firm in 2021, getting started can feel scary and uncertain without the right information, or the right tax planning software for accountants.

One sole practitioner who we now work with, had at one point thought about just giving up her firm and taking a consulting job. She was able to break $100,000 a month in revenue in just a few months after introducing tax planning to her firm.

Before introducing tax planning, she worried:

Her results from working with us include:

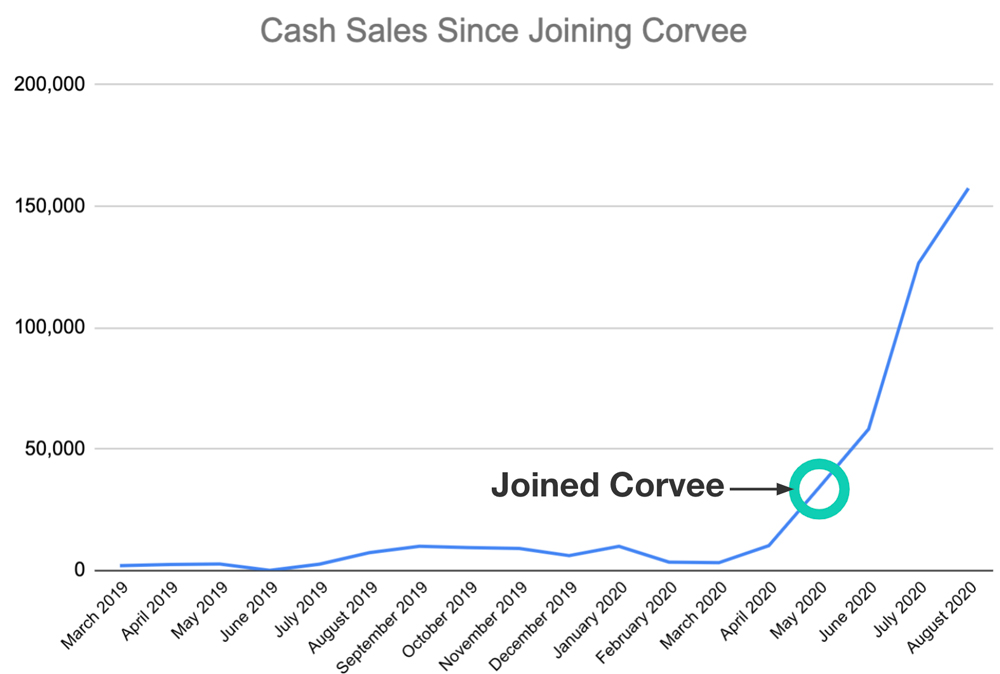

Here are her numbers showing her hockey stick growth:

Our client was able to achieve these results by applying the methods and strategies included in our training programs.

This just illustrates that once you get over your fears of just getting started on tax planning, the potential for massive success is there.

As mentioned, the problem with many accountants is fear in getting started. If all you’ve done is tax preparation, it can feel like a big leap. To make matters worse, most accountants can’t hold in their head dozens of strategies, multiple entities, deductions, credits, phaseouts and tax tables. It’s not even realistic to keep track of all that in an Excel spreadsheet—there are too many variables.

So, in short, tax planning is hard.

These are all valid concerns and should be addressed if you attempt to start tax planning on your own. The good news, however, is that Corvee has been able to automate the entire tax planning process to allow you to prepare accurate plans across thousands of strategy combinations in minutes.

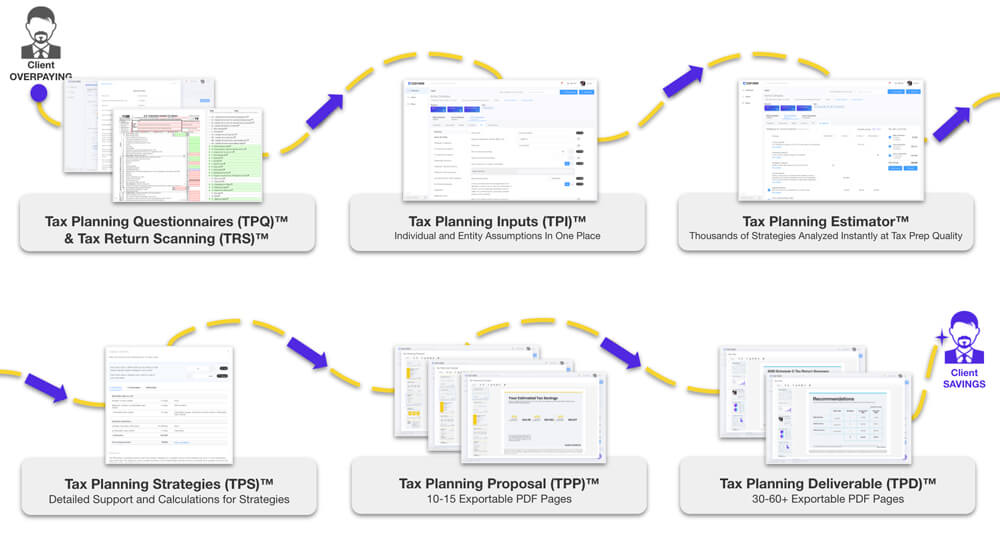

We’ve spent years mapping out how to solve every single detail of this process, and we call it the Yellow Brick Road of Tax Planning:

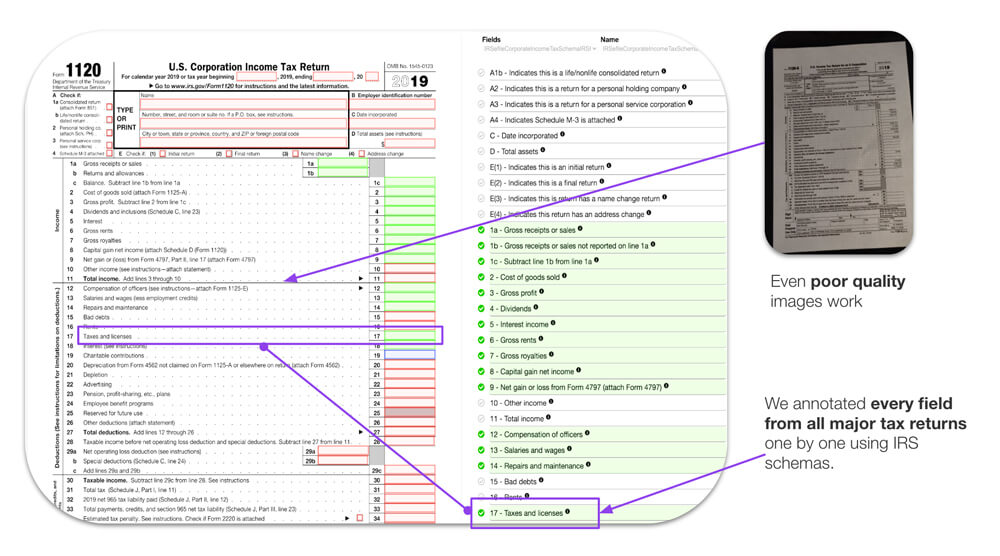

Our software allows you to scan every tax return and automatically calculate estimated savings with the data you’ve collected.* This includes:

Next, we provide a tax planning questionnaire so that you get every data input you need from clients in conditional questionnaires (individual and per entity). In fact, our questionnaire is built for conditional questions that will maximize or minimize potential tax savings strategies. From there, all you need to do is enter all the inputs you need to determine your estimated savings by entity and for the individual.

We make sure you’re able to include multi-entities, phaseouts, deductions, credits, marginal effective tax rate and more. And on top of all this, we give you the ability to dive deep into understanding the specific strategy and the inputs causing the calculation, and you can choose which strategies to include in the proposal. We even provide a summary of consolidated strategies into one easy-to-view table.

Your 10-15 page proposal can be exported within minutes to get clients to see the value and pay up front. Finally, we give a 30-60+ page deliverable you can export that shows the client the value of all the planning you’ve done!

So many accountants ask, “Will clients really pay 5-7x more for planning when they’ve been paying $600 for tax preparation for years?”

Once you show clients they are losing money without tax planning, they will pay for it even if they’ve been complaining about prices for decades.

As mentioned, we know getting started on a new advisory service like tax planning can be scary, but think about this:

If all we did was…

The potential of introducing tax planning in your firm is huge. The most successful tax and accounting firms of 2020 are offering tax planning to increase profit margins and get new clients in the door. It’s natural to upsell tax planning clients into other services, including tax preparation services, monthly accounting, CFO and wealth management.

2021 is the perfect time to get started because big tax changes could be coming. So, begin your journey today on the Yellow Brick Road of Tax Planning and get the tax planning software to make it easy!

*Note: Each tax preparation company makes slight alterations to IRS form. We may request blank copies of the tax returns you use to be able to ensure proper scanning to ensure for client accounts. This process may take a few additional weeks after onboarding.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.