10 minute read

Sole proprietorships, corporations, and partnerships all have different tax consequences. Do you understand the differences?

Business entity selection is one of the most important decisions you will make. And even though business owners make their entity selections for legal reasons – to limit liability, to have certain ownership options, or something else – you need to understand how your selections will impact your tax positions.

Forming a business entity is a legal action taken by a new business owner. Corporations, limited liability companies, partnershipsbvx c, and sole proprietorships are common entity types to choose from, although there are additional entity structures that vary by state like professional associations or limited liability professional corporations. In the following categories, we can draw comparisons between the main types of entities you are likely to encounter: sole proprietorships, partnerships, LLCs, and corporations.

Liability is often the most pressing matter for new business owners, and for good reason. Sole proprietorships and general partnerships do not limit business owners’ liabilities, which means owners are personally responsible for all business debts. Limited partnerships limit owners’ personal liabilities, but only for partners not participating in management decisions. LLCs and corporations provide the most protection by protecting owners’ personal assets from business debts beyond what they personally invested into the business.

Sole proprietorships can only be owned by one individual. Partnerships must have at least two partners but can have no more than 50. LLCs and corporations can be owned by any number of individuals.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

When the owner of a sole proprietorship dies, the business is dissolved. The same rule applies when one or more partners in a partnership die unless a specific clause is written into the partnership agreement. Limited partnerships, corporations, and LLCs (in most states) exist in perpetuity.

Sole proprietorships and partnerships almost always get their initial capital investments from the owners. Partnerships may be able to sell partnership interest in exchange for capital, but only if the partnership agreement explicitly allows for it. Similarly, LLCs can sell ownership interest in exchange for capital if the operating agreement allows for it. Corporations have the simplest time raising capital; they only need to sell outstanding shares or issue new ones.

Sole proprietorships and partnerships do not need to file any formation documents with the state. In contrast, both LLCs and corporations are required to register with the Secretary of State and file annual informational returns. But there are other formation documents businesses should consider. Partnerships, for example, should draft a partnership agreement that outlines responsibilities and expectations of the partners. Corporations and LLCs file similar documents; corporations call them “shareholder agreements” and LLCs call them “operating agreements.”

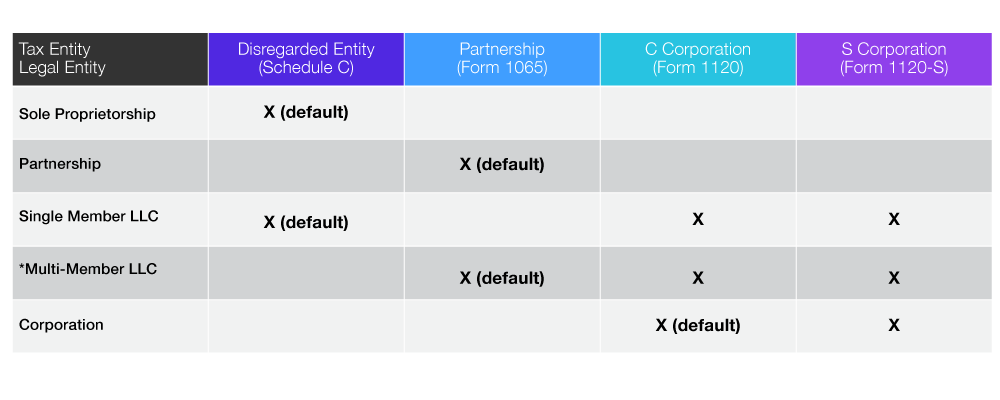

A business’s choice of legal entity will influence how it is taxed. The IRS taxes most businesses in one of the following three ways.

Each legal business entity is taxed one of these three ways by default, but they can often elect to be taxed differently. For example, just as our tax planning software shows, a multi-member LLC will be taxed as a partnership by default, but the LLC members can elect for their business to be taxed as a C corporation by filing Form 8832, or as an S corporation by filing both Form 8832 and Form 2553.

This means that selecting a legal entity is only part of the business formation process. Once legal entity is determined, you must decide how they want to be taxed.

A business owner’s tax position is highly dependent on their entity classification. Consider the following:

C corporations are the only tax entity whose revenues get taxed twice: first at the corporate level, then again when those revenues get distributed to the shareholders as dividends. Partnership, S corporation, and Schedule C businesses are only taxed once when business income, gains, and losses are passed through to the owners.

Self-employment tax is an additional 15.3% tax on the business earnings of self-employed persons. Sole proprietors and partners in a partnership are liable for self-employment tax on the portion of business earnings allocated to them. This is true whether they’ve taken cash distributions or reinvested their share of the profits into the business. S corporations are a bit different. S corporation shareholders active in the business often receive two forms of payment from their business: shareholder distributions and salaries. Only the amount of their pay classified as salary would be subject to self-employment tax. C corporation shareholders do not owe self-employment taxes on their corporate dividends they receive.

The corporate Alternative Minimum Tax (AMT) was abolished when Congress passed the Tax Cuts and Jobs Act (TCJA) at the end of 2017, so C corporations are not subject to this minimum tax. Individuals reporting pass-through income from partnerships and S corporations (and sole proprietors) may be subject to the AMT on their individual income tax returns.

C corporations are self-contained entities, so tax attributes like profits, gains, losses, and credits do not need to be allocated to individual shareholders. But for all pass-through entities, allocation matters. Tax attributes are generally allocated to owners in the same proportions as their investment, regardless of entity type, with one exception: partnerships. Partnerships can allocate tax attributes in whatever manner they choose – within reason – if it is written into the partnership agreement. The IRS will reject partnership allocations that exist solely to avoid taxation but does allow for creative allocations when there is an economic reason for doing so.

Changing entities may not be a simple process, but a tax planning software like the one we offer at Corvee can make it easier for you see how much you can save by changing your entity.

However, understanding the implications of an important change like this is crucial. That’s why Corvee Tax Planning software also lets you create a ready-to-send-PDF in minutes that fully explains how much each entity change can save you. In short, this means you can see how much money you can save, down to the dollar, if you should choose to change your entity.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.