9 minute read

The kiddie tax rules have been a bit fluid these past few years. The decades-old tax law changed when Congress passed the Tax Cuts and Jobs Act (TCJA) in 2017, and then again when they passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act in 2019. These changes can be difficult to track, but one major benefit arose from this flurry of legislative activity: freedom of choice. For tax years 2018 and 2019, Congress permits taxpayers to apply the version of the law that works best for them. With a bit of planning, you can make the optimal selection and maximize your tax savings.

The Tax for Certain Children Who Have Unearned Income, colloquially known as the kiddie tax, is an additional tax on a child’s investment income. This tax is calculated and reported on the child’s annual tax return unless the parents elect to report that unearned income as their own.

The kiddie tax was established in 1986 to prevent parents from shifting unearned income like interest, dividends, and capital gains to their children. Because children are almost always in lower tax brackets than their parents, transferring this income to children’s returns lowered families’ overall tax liabilities. Form 8615, Tax for Certain Children Who Have Unearned Income separates a child’s unearned income from their earned income and taxes it separately at the parents’ marginal tax rate, effectively negating any attempts to shift income into lower tax brackets.

Children are required to file Form 8615 if all the following are true:

The tax is assessed only against unearned income that exceeds $2,200. Unearned income is defined as all taxable income other than earned income. This means that all the following categories are considered in the kiddie tax calculation:

If parents would prefer to report their child’s unearned income on their own return, they can do so by filing Form 8814, Parents’ Election to Report Child’s Interest and Dividends.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

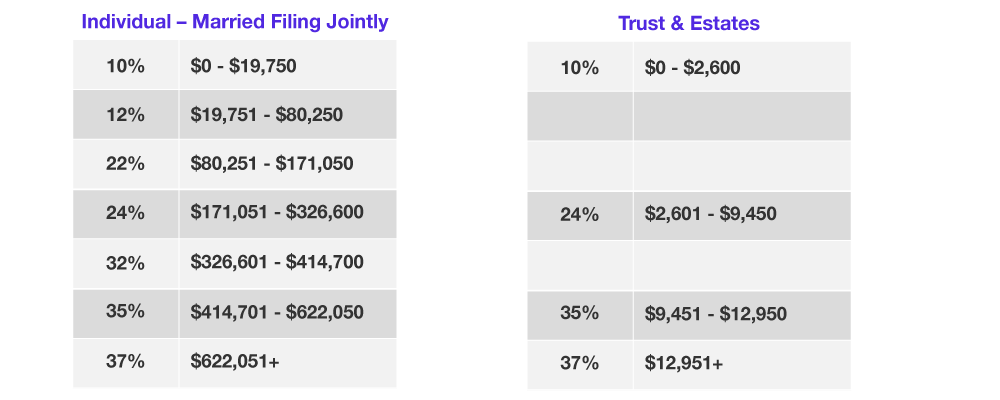

The kiddie tax calculation changed when Congress passed the TCJA in December 2017. As written in the law, beginning in tax year 2018 and through tax year 2026, a child’s kiddie taxable income would be taxed using the progressive tax tables for estates and trusts rather than the marginal tax rate of the parents. Disregarding the parents’ tax rates streamlined the kiddie tax calculation, which was especially helpful for divorced or separated parents or families with more than one child subject to kiddie tax. Although the relative simplicity of the TCJA-era kiddie tax rules was appealing, many taxpayers were saddled with a larger tax bill as a result. Estate and trust income tax brackets are narrower than income tax brackets, making it easier for kiddie taxable income to reach the highest marginal tax rate of 37%.

About two years later, as part of the SECURE Act, Congress effectively repealed the TCJA changes to kiddie tax. Beginning in 2020 and indefinitely into the future, kiddie tax rules reverted to pre-TCJA laws. This meant that a child’s unearned income was once again taxed using their parents’ marginal tax rates rather than the tax tables of estates and trusts.

The SECURE Act’s changes were motivated by the negative consequences the TCJA imposed upon Gold Star families. Gold Star families are immediate family members – spouses, parents, children, and siblings – of service members who were killed or died while serving in the Armed Forces. Gold Star families are often recipients of two types of survivor benefits: one from the Department of Defense (DOD) and one from the Department of Veterans Affairs (VA). Unfortunately, because of a decades-old rule against “double dipping,” Gold Star family members are unable to accept both. In an attempt to collect both, many survivors transfer one of the benefits to their children.

This shifting of income is captured under the kiddie tax under pre-TCJA and TCJA-era laws. But the TCJA-era laws almost always resulted in a higher tax bill for Gold Star families. Because these survivor benefits are generous, kiddie taxable income quickly reaches the maximum estate and trust tax bracket, ensuring most of the benefits are taxed at 37%. When transitioning the laws back to pre-TCJA standards, these benefits were instead taxed at the parent’s marginal tax rate, which – for most taxpayers – produced a lower tax bill.

In tax years 2018 and 2019, taxpayers chose the calculation method that works best for them. They can calculate kiddie tax using the parents’ marginal tax rates or using the trust and estate tax brackets. The law even permits taxpayers to amend returns to take advantage of this opportunity. In 2020, the law reverts to pre-TCJA law and only the parents’ marginal tax rates can be used.

If you have children who are subject to kiddie tax, this is something you should explore further. There may be a tax saving opportunity! You will need to prepare proforma returns to compare the results. By doing this strategic planning, you can make the most optimal selection.

Also, keep in mind with continuing legislative changes that can be difficult to track, tax planning strategies are more complicated than ever. Take out some of the complexity with Software, which can help you access thousands of possible strategy combinations on a multi-entity, multi-year basis.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.