7 minute read

This quote could sum up the experience of many within the tax & accounting industry:

“As an accountant, I was so busy between February and April of last year I didn’t realize until later that when I calculated all the hours I had worked, I was actually making less per hour than the teenager behind the register at McDonald’s.” —Anonymous 1040 preparer

Ouch. Having a mountain of 1040s and business returns on your plate means a lot of work, but at what cost? The key to a successful firm isn’t being busy, it’s being profitable with high-margin services and an improved accounting firm business model.

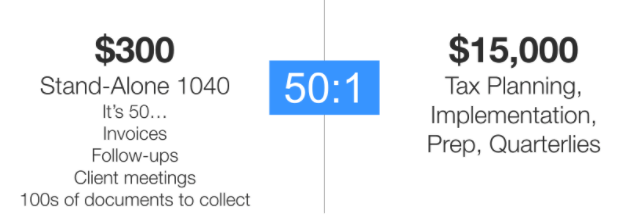

Look at the national averages for tax preparation:

How much are you charging? Even if you have higher prices than these, the fact is, tax prep is a low-margin business. If you want to get out of the “rat race” of doing never-ending compliance for clients you must switch gears.

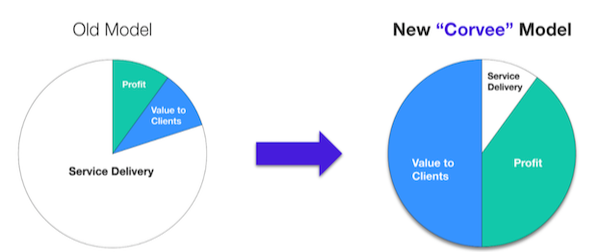

This is why many tax professionals have no time:

If you can move your annual tax preparation clients to quarterly recurring tax advisory services clients, this will do wonders for your firm’s financial security.This recurring tax advisory fee model works because clients are happy to pay you every 90 days when you save them money by doing all of the following:

This tax advisory model is a blueprint to grow even during a time of crisis when the economy is in trouble and inflation is at the door. Now, you may be saying to yourself, “I don’t even know how to do tax planning.” The good news is you don’t need to know, because software can do a tax plan for you (and teach you as you go).

We live in a world where tax planning is necessary if you want to provide your clients with savings and value. The goal of every tax and accounting professional should be to have a tax planning system that can potentially save your clients tens of thousands of dollars every year. Otherwise, you’re just a poorly paid form-filler, punching numbers into a calculator.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

Susan knew she was seen as a form-filler. She wanted to upgrade clients to pay 5x–7x what they were used to paying for preparation. But how? And why would they pay more than $600, the same rate she had been charging since 2012?

Well, Susan realized if she wanted clients to pay that much more, she couldn’t just do tax preparation. That service is low-priced and backward looking, which drives down what she can charge clients because it’s viewed as a commodity. On the other hand, Susan also learned that a service like tax planning is advisory, outcome-focused and future-oriented with a high ROI — which drives higher prices and greater profitability.

In her own words, she asked…

“If a client is willing to pay $600 for the preparation of a business return, would they be willing to pay $2K per quarter if I could perform proactive tax planning and save them $26K?”

The answer is yes, about 65% of the time. We work with many firms and know what clients around the nation are willing to pay.

So, Susan began to offer tax planning during tax season, which presented a unique upsell opportunity to existing clients who were already thinking about how much they were going to pay the IRS. Their tax returns were top of mind, so Susan was able to easily repackage her prep services by adding components such as tax planning as a one-time or quarterly recurring service.

And with tax planning software available, her whole process became much easier than she imagined. She was able to instantly calculate over 60 tax planning strategies across multiple entities and years to quickly estimate tax savings she could find for her clients.

Another firm owner has used the same tax advisory method to launch his firm from under $300k in revenue in 2019 to over $1.9M in 2021. Now he has over 175 clients paying him quarterly recurring payments for this service…that technology mostly does for him. All because he added tax planning on top of the tax preparation he was already doing.

Still another firm owner combines accounting services with tax advisory and now has over 44 clients paying her on average over $20,000 a year each. That’s over $800k in recurring revenue each year…not bad, right?

Certainly beats $400 tax returns!

Individuals and businesses are overpaying their taxes by filing returns that don’t reflect their situation & circumstances. For example…imagine one of your clients owed $23,392 in taxes, but what she really paid was $29,382. Her overpayment was a result of incorrectly filing or missing 6 items which would have resulted in $5,990 tax savings.

That said, both individuals and businesses can save money on taxes if they know additional strategies and implement them. For example…if that client of yours could implement 4 strategies for an additional $7,239 of tax savings. She has gone from paying $29,382 to $16,153 in taxes which is a $13,229 savings [45%].

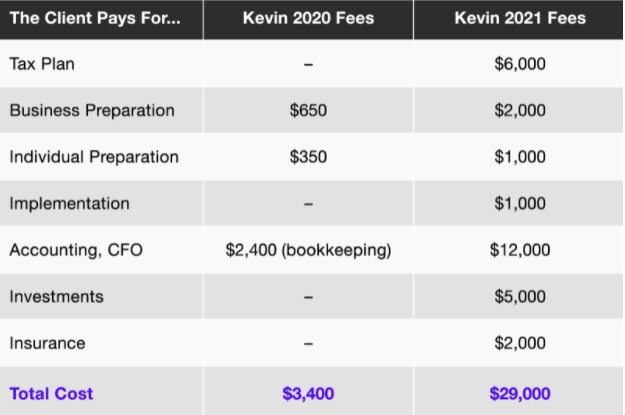

Kevin has gone into this service model and here’s what it looks like (and how drastically different it is compared to how it used to be).

The crazy thing is, his clients are actually saving money despite paying him over $25,000 more. But how do you put this into practice and lock in recurring revenue? When it comes to menu options, there’s certain services we recommend you offer and other services you should not bother with.

Here’s what we do recommend:

Here’s what we don’t recommend:

However, it’s important to not bundle certain things together. For example, here are services to keep separate:

Business Returns: $2,000+ minimum per return

Schedule C: $1,200+ minimum per return

Individual Returns $1,000+ minimum per return

Clean Up: Numbers of months X monthly rate X 50%

Tax Planning: 30% of estimated savings up to $9,800

Implementation: $1,000-$10,000+ depending on scope, savings

Quarterlies: 30% of estimated savings, $1,000/quarter minimum

During periods of high inflation, you want consistent revenue coming in. Avoid one-time payments and shoot for:

The US tax code is over 70,000 pages long, which is why the average person spends money to get their taxes done. That’s where you come in, right? The thing is, you don’t have time for 70,000 pages of tax code either. That’s where software comes in, built by accountants for accountants.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.