8 minute read

If you are an accountant and have a goal of becoming an outsourced CFO, the single biggest problem you need to understand is the importance of nailing down the proper scope for each of your future CFO and monthly accounting engagements. When a client becomes annoying, it’s because you didn’t clarify the scope from the beginning. The amount of work and effort that goes into the engagement begins to eat away at your profits, and resentment builds. To grow an accounting practice, you must avoid this.

If you already have a mess on your hands where you weren’t clear on the scope of a monthly accounting engagement, the goal will be to restructure the deal and be their outsourced CFO instead. Besides restructuring old engagements, sell in all new clients with the correct pricing and scope.

How do you identify the right pricing structure for these types of engagements?

Unfortunately, when talking to most accountants, they lump together many services into one low price ranging from $100-$300/month. When these low priced clients start frequently reaching out to the accountant, the resentment builds. The more you engage with questions and move out of scope, the expenses associated with the engagement continue to rise. A successful accountant is able to put a stop to this in order to grow an accounting practice.

You need to have separate prices for separate services!

Each one of these should be a separate fee. Do NOT lump any of this together into one price!

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

A setup is when the client has not set up an accounting system in the past, and you’re going to help get them started. This can also include setting up a new business entity that hasn’t existed and doesn’t have an accounting file.

The client has set up an accounting system, but it’s in shambles. They aren’t able to use their system due to errors or the system simply never having been set up properly.

If you’re doing recurring sub account management (AR, AP, payroll), monthly accounting, controller, or even Chief Financial Officer...your new rule for pricing is as follows: $500/month for every $500,000 in annual revenue per tier of service.

For example, if you’re doing monthly accounting and sub account management work for a client who has a $1,000,000 business, that means you should be charging at minimum $2,000 per month ($500 x 2 tiers of service= $1,000 x 2 for additional $500K revenue in client’s business).

Example #1: Jake

Jake is a successful accountant and has a new client with a $2,000,000 business. He will need to do 6 months of cleanup, then will be doing their accounts payable on bill.com along with their monthly accounting:

$2M business = $2,000 per tier of service ($500 per $500k).

The cleanup is as follows: (Numbers of Months X Monthly Rate X 50% = Clean Up )

So, the cleanup would be $2,000 X 6 X 50% = $6,000

Both the AP and the monthly accounting would be $2,000 each per month. Therefore, Jake would charge like this:

$6,000 + $4,000/month. That should be a $48,000 annual engagement with $54,000 the first year. This is an example of how to NOT lump your prices together and have proper scope so you don’t undervalue your time and energy.

Example #2: Beth

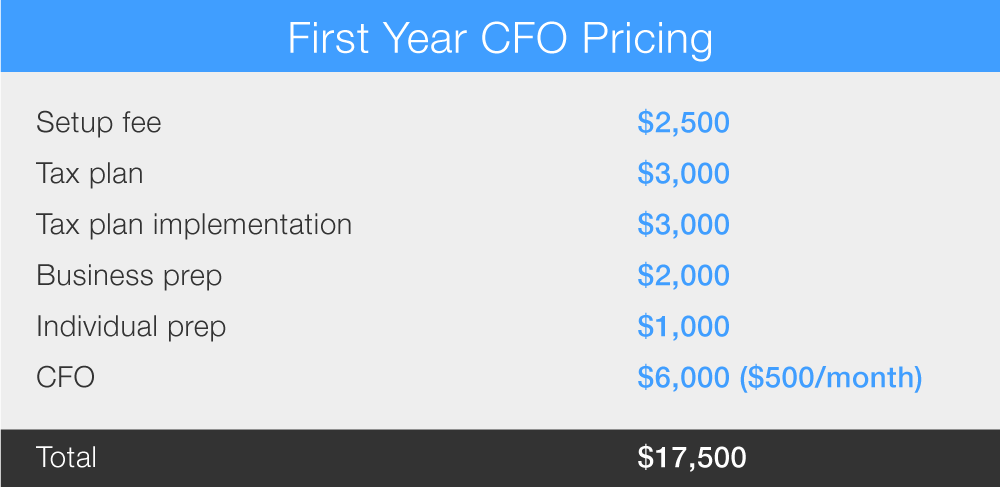

Beth is a successful accountant that has a new client with just a $400,000 business. She needs to do a setup as well as build and implement a tax plan. In addition, she’ll also be doing his business and individual tax prep and CFO work moving forward.

$400k business = $500 per tier of service for CFO work ($500 per $500k). Beth will be their CFO for $6,000 a year until they hit $1M, at which time that price would double.

The setup fee = $2,500

Her tax plan will save him $10,000, so she charged him $3,000 for it. He wanted her to implement the tax plan as well, which is another $3,000. His business prep is $2,000 and individual prep is $1,000.

As you can see, everything we’re discussing here involves charging separate fees for separate services. The biggest mistake you make in pricing is lumping services together for one price. This causes you to work for too little compensation for your time. Let the bean counter accountants work for $50 an hour. You need fixed pricing that values your services if you desire to be a successful accountant.

You will never be able to grow an accounting practice if you keep doing low-priced 1040s, focusing on endless tax preps and time-consuming bookkeeping with clients that have no regard for the scope of what your responsibilities are. You need to become a CFO with pricing to match your new role!

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.