9 minute read

When finalizing your tax projection this year, don’t forget about the 2021 Net Investment Income Tax (NIIT) liability.

The NIIT is an additional 3.8% tax on investment earnings. The NIIT won’t affect every taxpayer, but if you are a high earner, you should include a NIIT estimate in your projection so you are prepared — mentally and financially — for the additional liability.

The NIIT is a tax on earnings from investment activities net of deductible investment-related expenses (aka “net investment income”). Even though the definition is simple, calculating the NIIT can be confusing. Here are a few common questions taxpayers and tax advisors have about the NIIT.

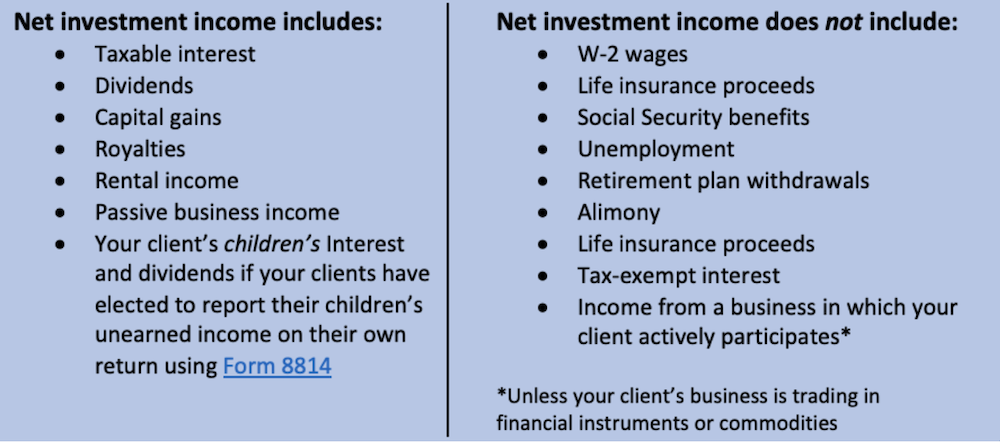

Net investment income is income earned from investment activities, like interest, rent and royalties. Actively earned income — like wages from a day job or income from a family business that you operate — is not subject to the NIIT.

Investment expenses are costs you incur in investment-related activities. Deductible expenses include brokerage fees, advisory fees, tax preparation fees, fiduciary expenses and expenses related to rent and royalty activities.

Individual taxpayers are subject to the NIIT when two things happen: (1) when they have net investment income, and (2) when their modified adjusted gross income (MAGI) exceeds the following thresholds:

| Married Filing Separately | $125,000 |

| Single | $200,000 |

| Head of Household | $200,000 |

| Married Filing Jointly | $250,000 |

| Qualifying Widower | $250,000 |

Estates and trusts are also subject to the NIIT if they have (1) undistributed net investment income and (2) AGI over the following thresholds:

| Tax Year | AGI Threshold |

| 2019 | $12,750 |

| 2020 | $12,950 |

| 2021 | $13,050 |

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

To calculate the NIIT, you’ll need to collect investment income, investment expenses and MAGI.

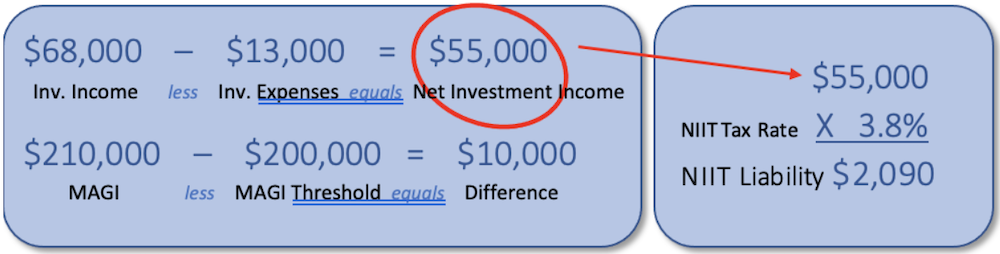

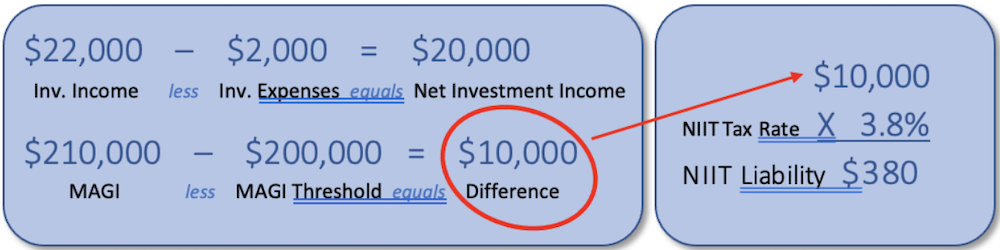

The tax is calculated as 3.8% of the lesser of (1) net investment income, and (2) the amount at which your MAGI exceeds the applicable threshold. Let’s look at two examples:

Example 1:

You are single and have investment income of $68,000, investment expenses of $13,000 and MAGI of $270,000. Your NIIT liability would be $2,090.

Example 2:

You are single and have investment income of $22,000, investment expenses of $2,000 and MAGI of $210,000. Your NIIT liability would be $380.

If you aren’t familiar with the NIIT, it may be because it is a relatively new tax. It went into effect in 2013, a few years after it was passed. It was passed in 2010 as part of the Health Care and Education Reconciliation Act, which was a law that amended the Affordable Care Act (ACA).

The NIIT is a permanent addition to our tax code, but its close ties with the ACA place it in a precarious position. The ACA has been taken to court many times, most recently in the Supreme Court Case California v. Texas. The judgment issued in this case upheld the ACA, but the challenges to the ACA are likely to continue. There is not going to be a net investment income tax repeal in 2021, but if the ACA is repealed in the future, it is highly likely the NIIT would also be repealed.

The Net Investment Income Tax form for individuals, trusts, and estates is Form 8960. The form calculates your NIIT liability, which will then flow to Form 1040 (or applicable tax form) along with your income tax liability.

You can shrink your NIIT liability by (1) reducing the amount of investment income reported, and/or (2) reducing your MAGI. You could do this in a few ways:

Donate appreciated securities to charitable organizations.

By donating appreciated stock to a charitable organization, you would be foregoing capital gain recognition and gaining a charitable deduction. But this technique will only work if you itemize your deductions.

Invest in municipal bonds.

Interest earned from municipal bonds is tax exempt and therefore not subject to the NIIT.

Maximize contributions to qualified retirement accounts.

Growth within qualified retirement accounts is tax deferred until withdrawal. This not only reduces investment income, but it also allows you to take a current-year deduction for contributions, which will reduce your MAGI. Just remember that the traditional IRA deduction may be limited if your retirement plan is sponsored by your employer.

But the most important thing to remember is that, like income tax, you must pay your NIIT liability equitably throughout the year, either through employer withholdings or as estimated taxes. In our Corvee Tax Planning software, we include a NIIT calculation that you can use to help plan for the year ahead.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.