12 minute read

If you have a tax firm, it’s vital to do tax planning for clients in addition to merely preparing tax returns. These are the five main categories which have the biggest impact on potential tax savings for your clients. They are:

Within each of these categories, there are components that you want to look at to see whether or not your prospect is taking advantage of. As you garner experience, you will learn which tax savings strategies offer the biggest savings. We will review some of the more obvious ones, but there are dozens, if not hundreds, of components to look at under each category.

Keep in mind that you have a limited amount of time on the call to calculate how much you can save this prospect. This is why during the strategy session, you want to initially focus on the core strategies. Once they become a tax planning client and you have all their information, you can go through and apply any other strategies that will save them even more money than your initial estimate. We’ll also cover how using tax planning software can help you with all this!

One example of a core strategy to maximize deductions is an administrative home office. Let’s take the example of a doctor who has a home office to work on the administrative tasks related to his practice such as bookkeeping, billing, reviewing patient files, etc. If you can establish his home office as an administrative office, then he is able to deduct the mileage between his home office and his medical office where he sees patients, thereby increasing his deductions. Keep in mind that at this point you do not need to know how to implement the strategy; you are simply going through to see what strategies may be available to this prospect and how much you could potentially save them in taxes.

Potential Strategy Session Questions:

“Do you have an office outside your house?”

“Do you do work at home?”

“Do you reimburse yourself for those expenses?”

You can also use tax planning software to help you quickly calculate possible deductions.

Once you have gone through and calculated how much to save the client by maximizing deductions, you want to figure out if they are organized under the best business structure. Approximately 75% of small businesses are organized as a Schedule C. Fortunately for us, it rarely makes sense for a business owner to remain a Schedule C. By moving them over to an S-Corporation, Partnership, LLC or even C-Corporation, you will often be able to significantly minimize their taxes.

Potential Strategy Session Questions:

“What kind of tax returns do you file?”

“How many entities do you have?”

“What entities do you have?” “How much income is in each of those entities?”

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

After you have gone through the calculation for the first two categories, you should move next to questions regarding the prospect’s retirement accounts and insurance deductions to see if there are any potential tax savings there. For example, while IRA accounts are popular, they only allow very limited contributions each year: only $5,500 unless the prospect is over 55 years old. Therefore, if you discover that a prospect is contributing to an IRA, you know that moving them over to an SEP or 401(k) would potentially result in a bigger deduction and more tax savings.

Additionally, you will want to ask what kind of insurance they have and make sure they are using health and dental insurance deductions to the full extent available. Life insurance does not fall under this category, because life insurance premiums are not tax deductible. However, other forms of insurance are deductible and can result in even more tax savings.

Potential Strategy Session Questions:

“Are you currently making retirement contributions?”

“How much do you contribute each year?”

“What kind of plan do you have?”

Depending on what niche you are in, you will employ different strategies to help your prospects save money on taxes. For example, the real estate niche often makes use of Sec. 1031 exchanges and cost segregations to help avoid capital gains and increase depreciation, respectively. Restaurants have the FICA tip credit, and tech companies have research and development credits. As you become more and more familiar with your niche, you will have a better idea of the niche strategies used to save your clients even more money in taxes.

Potential Strategy Session Questions (Real Estate-Specific):

“Do you own real estate?”

“How long have you owned your real estate?”

“How are the properties performing?”

“How much debt do you have on the properties?”

“How much did you pay for the property?”

“What do you think it is worth now?”

“What are your goals regarding real estate?”

Some of the more common advanced strategies are the Augusta Rule and captive insurance. The Augusta Rule is a loophole available to nearly all business owners. It allows you to host business events, for example quarterly board meetings, at your home, and exclude the income from the rental on your personal return, but take the rental deduction on your business return. Captive insurance is not as common and typically requires a business to have fairly high income, over $500,000 every year, in order to take advantage of this strategy. However, for companies that do qualify, this is a great advanced strategy to employ that could potentially result in significant tax savings.

Potential Strategy Session Questions:

“Tell me about your house?”

“Do you have the capacity to host business events at your home?”

Once you have gone through the script and structured your questions to ask about the core tax savings strategies, you will be able to estimate how much you can save a potential prospect while on the phone during a strategy session.

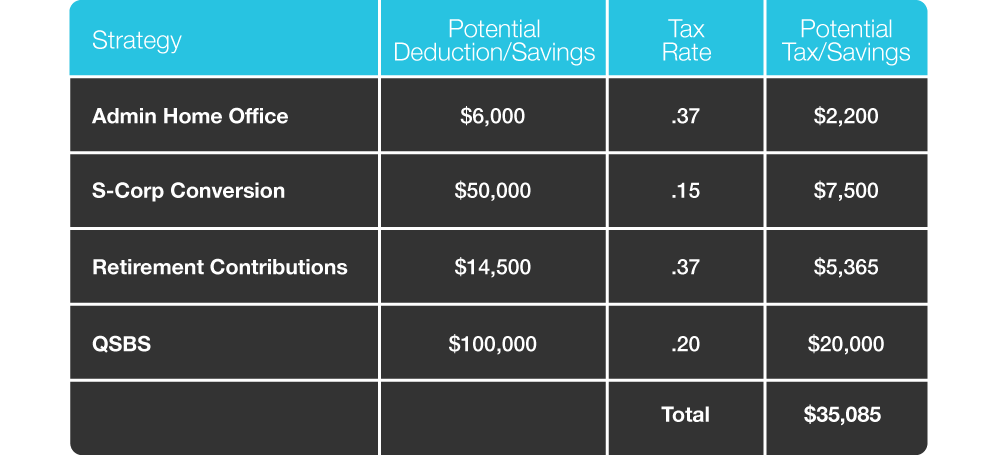

Let’s take the example of William: During a strategy session with a doctor, William determines that he can save the prospect $35,085 in taxes using the following method. Through basic questioning he determines the doctor is in the 37% tax bracket. William realizes he can maximize deductions using an administrative home office. By asking about utilities and housing payment, he decides to be conservative and estimate $500/mo of savings for a total of $6,000 which he inputs into the Tax Savings spreadsheet. He can also move the prospect from a Schedule C to an S-Corporation.

The business is currently netting $100,000 per year so William estimates he can put the prospect on a $50,000 salary and save payroll taxes on the remaining $50,000. Therefore, in the spreadsheet he inputs the $50,000 at a 15% payroll tax rate instead of the full income tax rate. William also determines he can increase retirement contributions to $20,000 per year up from $5,500 per year by converting the prospect to an SEP. He inputs the difference of $14,500 into the spreadsheet.

He also learns that the prospect has a medical device startup on the side that he and his co-founder are selling this year, which qualifies for Qualified Small Business Stock treatment. He determines that he can use the QSBS strategy to eliminate $100,000 of capital gain. William inputs $100,000 multiplied by the prospect’s capital gain rate of 20% into the spreadsheet. At the end, he arrives at the total amount of $35,085 estimated tax savings:

As you learn more strategies, you will learn to ask better questions and find more ways to save the prospect money. Occasionally, once a prospect decides to move forward on implementation, you may find that a client does not qualify for a strategy that you thought was viable during the strategy session. However, it is rare that you will not be able to find other strategies that will save them at least as much, if not more than your initial estimate.

Overall, using the five main approaches outlined above, in conjunction with Corvee Tax Planning software, can help you make the switch from just doing tax preparation to doing tax planning. This tax planning software helps you collect client information from questionnaires, analyze estimated tax savings, prepare proposals on the spot and give tax plans to clients within minutes.

In addition, Corvee Tax Planning includes more than just the five main approaches discussed above, but has hundreds of tax planning strategy combinations right out of the box. It even uses machine learning and artificial intelligence to identify within your client’s documents the most important information to quickly formulate a tax savings calculation. If you want to save time with offering tax planning as an advisory service for the growth and development of your firm, then hit the button below for your free demo of Corvee, an accounting practice software that can help optimize tax savings for your clients and even do the tax plan for you.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we’ll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.