9 minute read

Are your clients worried about the estate tax?

When taxpayers learn that the estate tax rate is 40%, many become concerned about their ability to pass their wealth onto the next generation. But they shouldn’t be concerned. With proper tax planning and with help from a good tax planning software, almost all your clients can avoid the estate tax. If they make gifts throughout their lifetime rather than save their wealth transfers until their death, they can avoid the estate tax and use those tax savings to secure the financial futures of the people they care about.

Understanding the mechanics of how gift and estate taxes worth together is crucial, so let’s start from the beginning.

Although Congress has taxed transfers of wealth off and on since the Civil War, the estate tax as we know it was established in 1916. In the century that followed, the estate tax was renewed time and time again until it was made permanent in 2012 as part of the American Taxpayer Relief Act.

An estate is a legal entity that is created only when a taxpayer passes away. The property the taxpayer owned at their death is transferred into their estate. Following the directives of an executor, the estate protects and manages those assets until they can be distributed to the decedent’s heirs or liquidated.

An estate is treated as a separate entity for both legal and tax purposes, which means that it can make debt payments on behalf of the estate, manage the decedent’s ongoing or past affairs, and make investment decisions about the decedent’s assets. This also means that it files its own tax returns and pays its own tax – if it owes any – on Form 1041, U.S. Income Tax Return for Estates and Trusts.

The estate tax calculation is quite simple. The gross estate is first reduced by allowable deductions. Common deductions are:

Once these expenses have been deducted, the balance is further reduced by the federal estate tax exemption. In 2021, the estate tax exemption was $11.7 million. The amount that remains – the taxable estate – is taxed at a rate of 40%. Because the $11.7 million exemption is so generous, it’s estimated that only .07% of the population pays estate taxes.

Gift tax is assessed when an individual gifts another person something of value during their lifetime. This includes gifts of tangible assets like vehicles, homes, or jewelry, but also intangible assets like business interests, stock shares, or trademarks. Like the estate tax, the recipient is not liable for the tax; rather, the taxpayer who gifted the assets is liable.

Each year, taxpayers are permitted to gift others up to $15,000 (in 2021) completely tax free. A married couple can each give $15,000 per recipient per year, allowing a couple to reduce their estate by $30,000 per year. This exclusion is per recipient, meaning that taxpayers can make multiple $15,000 gifts each year without paying tax. If a taxpayer transfers more than this threshold to another person, they will need to report that gift by filing Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. A gift tax return will track the amount of taxable gifts a person makes throughout their lifetime. But like with the estate tax, most taxpayers will never pay gift tax, and that’s because gifts in excess of the $15,000 annual exclusion are only taxable if they cumulatively exceed the lifetime $11.7 million estate tax exemption. This shared exemption is where gift taxes and estate taxes overlap.

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

The gift and estate tax are similar: they both tax transfers of wealth. When assets are transferred during the giver’s lifetime, the gift tax applies. When assets are transferred at the giver’s death, the estate tax applies.

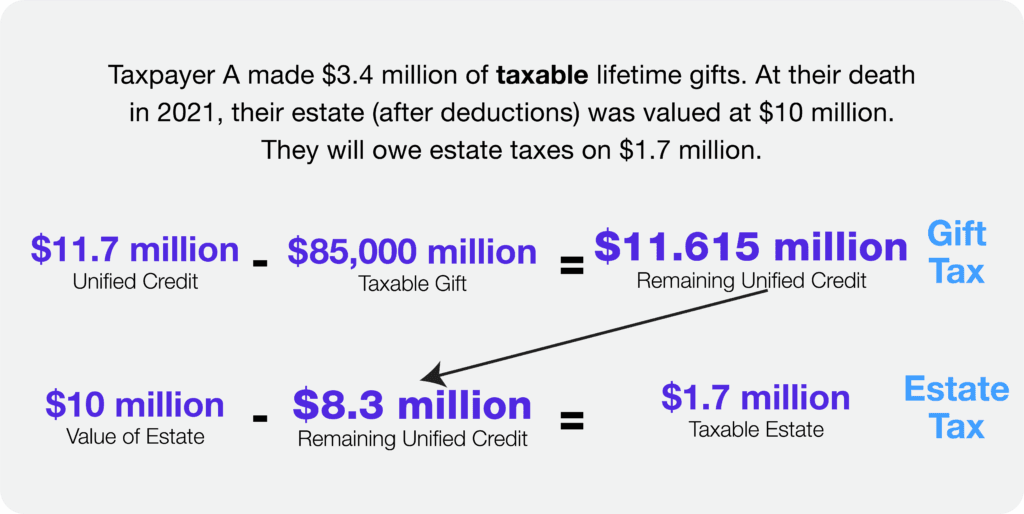

The reason the estate and gift tax are so intertwined is because they share the same exemption. The $11.7 million estate tax exemption is often referred to as the “unified credit” because gifts and estate transfers utilize the same exemption. Consider the following example:

Each year that the taxpayer makes gifts in excess of the $15,000 annual exclusion, they will reduce their unified credit. At the end of their life, anything that remains can apply against their estate. Consider this example:

These examples show just how important gift tax planning can be. If your clients are wealthy, they should take advantage of the annual gift tax exemption so that they can preserve their unified credit to be used at their death.

The $15,000 annual gift tax exclusion is the best tool your clients have at their disposal to reduce their gift/estate tax liability. Here are two options available to your clients:

Your clients can make scheduled gifts each year that are at or below the $15,000 per recipient, per year gift tax exclusion. These amounts are freebies; they are not taxable, and they will not affect their unified credit.

If your clients don’t want their recipients to have access to gifted assets immediately, they can use the ,000 annual gift tax exclusion in combination with a trust. By gifting assets to a trust that benefits their loved ones, they simultaneously preserve their unified credit and withhold the assets from their loved ones until a predetermined point in the future.

There are – of course – other tax planning options available to your clients who want to avoid the estate tax, but utilizing the $15,000 annual gift tax exclusion is a great starting point. This exclusion may not seem like much, over a giver’s lifetime, it can add up.

If you want to grow your tax practice beyond compliance work, talk to your clients about their estate. Do they have an estate plan? Have they considered making lifetime gifts to take advantage of the annual exclusion?

If your clients express interest in creating an estate tax plan, make sure you have a quality tax planning software at your fingertips. Corvee tax planning software is unique because it allows you to change multiple assumptions at once so that you can show your clients how those changes will affect them years into the future. This tool will be invaluable when establishing a long-term tax plan for your clients and can be updated each year if their situation changes.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we'll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.