Find Savings for Every Client

Find Savings for Every Client

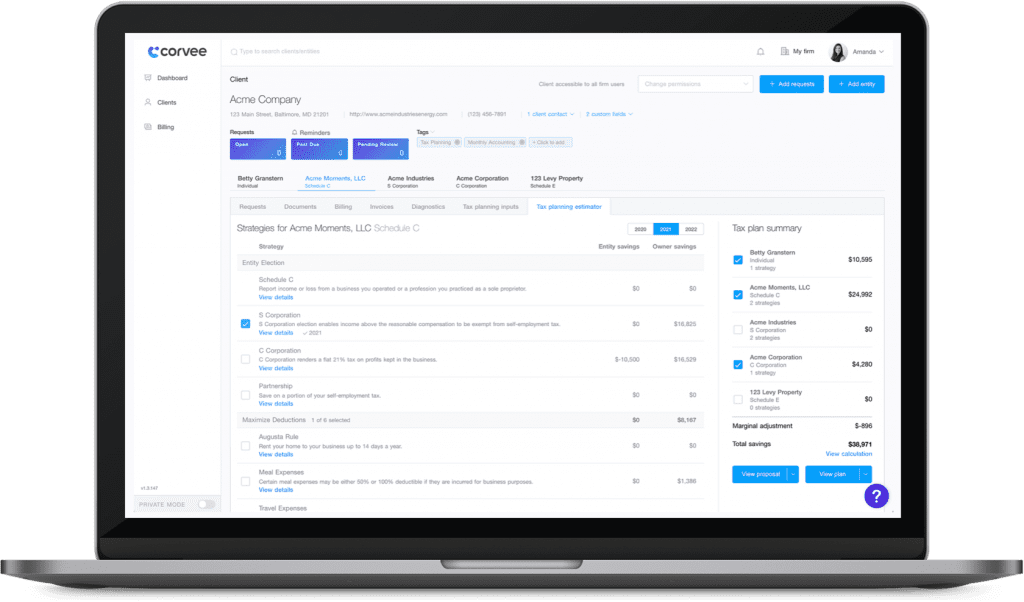

Don't just tell clients what they owe in taxes. Tell them how much you can save them. Quickly find and calculate over 1,500 strategies at both the Federal and State level to legally reduce your clients taxes.

Find Savings for Every Client

Don't just tell clients what they owe in taxes. Tell them how much you can save them. Quickly find and calculate over 1,500 strategies at both the Federal and State level to legally reduce your clients taxes.

Whether you’re an accountant, tax preparer or financial advisor, the Corvee Platform is your comprehensive solution to help you do tax planning right.

Whether you’re an accountant, tax preparer or financial advisor, the Corvee Platform is your comprehensive solution to help you do tax planning right.

Filing accurate forms for tax compliance is essential. But tax planning allows you to be an even more valuable partner to your clients. With Corvee tax planning software, you’re not just preparing tax returns at the end of the year — you’re strategizing with your clients on the tax implications of their business decisions before they make them.

Filing accurate forms for tax compliance is essential. But tax planning allows you to be an even more valuable partner to your clients. With Corvee tax planning software, you’re not just preparing tax returns at the end of the year — you’re strategizing with your clients on the tax implications of their business decisions before they make them.

New to tax planning or need support? You don’t have to go it alone. Corvee was designed to empower tax planners of all levels — from veterans to those who are just starting out. Master tax planning with the support of our client success team and a community of tax planners just like you.

New to tax planning or need support? You don’t have to go it alone. Corvee was designed to empower tax planners of all levels — from veterans to those who are just starting out. Master tax planning with the support of our client success team and a community of tax planners just like you.

Private client community for power users coupled with those who have built successful tax planning firms

Descriptions, tax code references and requirements for every tax-saving strategy, right in the tool

Dedicated client success manager and free support via chat, email and phone

Direct access to Corvee’s team of tax and accounting experts to answer your questions

Join 10,000+ customers who are already saving money in taxes.

See how easy tax planning can be with Corvee.

Please fill out the form below.

Fill out the form below, and we'll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.