6 minute read

2020 was a year with far-reaching economic ramifications, but 2021 is also shaping up to be quite the year. Significant tax law changes are in process and more may be on the horizon. Here are 4 major themes to consider when thinking about 2021 tax planning.

There are big changes happening for both individuals and businesses. Here are just a few of the major changes being discussed:

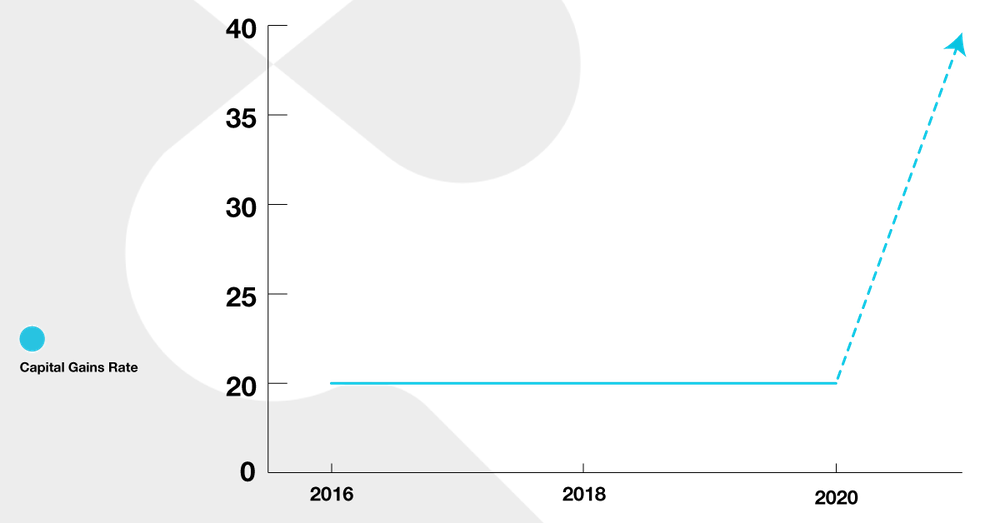

For many Americans, the biggest tax consequences of the latest tax policies could be capital gains. Currently, the highest capital gains rate is 37.1% (for those in California over a certain income bracket). Let’s take a look at the current standard rates, minus any state tax:

In California the top rate would be 56.7% (39.6% + 3.8% + 13.3% state). When taxes are increased, people begin to look for ways to save. This is why the latter half of 2021 is shaping up to be one of the biggest tax planning seasons of all-time.

The new Coronavirus Relief and Omnibus Agreement at the end of 2020 updated many tax credits, including Earned Income Tax Credit (EITC), Paid Sick & Family Leave, Business Meals and Work Opportunity Tax Credit.

In addition, the American Rescue Plan (ARP) made significant changes to the Child Tax Credit. This legislation increased the credit from $2,000 to $3,600 for children under the age of 6, and from $2,000 to $3,000 for all other children under the age of 18. Taxpayers are now getting access to monthly payments and can claim the remainder of the credit when they file their 2021 return.

Other updated credits to be aware of for 2021 tax planning include:

Scan client returns. Uncover savings. Export a professional tax plan. All in minutes.

The EITC is available to lower-income people with earned income, acting as a wage subsidy. The ARP changed the maximum credit for workers without children from $540 to $1,500. The timeframe for receiving this credit was also expanded. Those over 65 can now claim it as well as those between 19 and 24.

Meanwhile the Paycheck Protection Program (PPP), a loan guaranteed by the Small Business Administration an SBA-backed loan that helped businesses keep their workforce employed during the COVID-19 pandemic, has also undergone changes. PPP loans are once again available in 2021. This round, $25 billion has been allocated for small businesses in low-income areas with 10 or fewer employees, or loans less than $250,000.

It’s more important than ever to consider whether you are operating under the best entity for your goals because it has a significant impact on taxes. A less than ideal entity could result in overpaying the IRS, and most business owners and their accountants haven’t calculated how much money they’re losing every year.

Take for example those who have C Corporations, where owners or shareholders are taxed separately from the business itself. Practically speaking, this results in taxing of profits at both corporate and personal levels, creating a situation called double taxation. This is why some people might consider changing their C Corp structure this year, especially if they’re not concerned about going public.

Firms that are supporting strategic entity planning can help optimize your tax situation in 2021.

With the prospect of an ongoing pandemic, we expect more economic challenges for small business owners into 2022. This means more legislation could be on the way—with more tax incentives and changes.

The key to navigating this ever-evolving array of tax rules is to stay up-to-date with the latest developments, which is no easy task. Between the state of the economy, the status of COVID-19 and other international events, it’s difficult to predict what new legislation is on the horizon. 2021 has already shaped up to be a monumental tax planning year, and 2022 will likely bring more changes. As an accountant, we know it can be difficult to predict tax changes, but you can still do proactive tax planning using these four themes to deliver value to your business.

See how Corvee allows your firm to break free of the tax prep cycle and begin making the profits you deserve.

Please fill out the form below.

Fill out the form below, and we'll be in touch.

Please fill out the form below.

Please fill out the form below.

Please fill out the form below.